Business, 28.11.2019 03:31 gadgetady5699

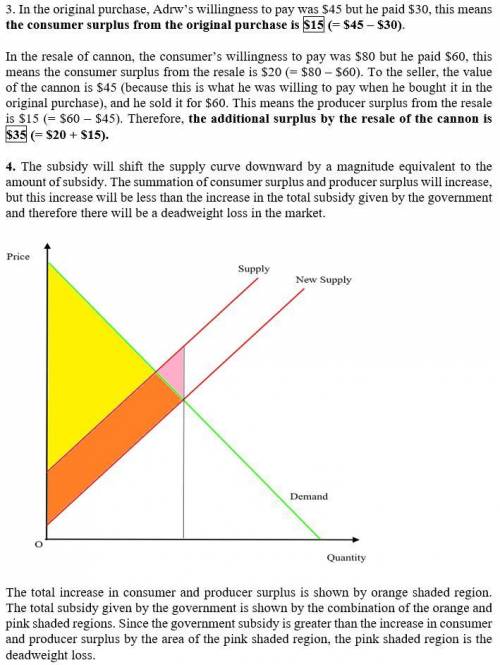

Chad paid $30 to buy a potato cannon, a cylinder that shoots potatoes hundreds of feet. he was willing to pay $45. when andrew’s friend nick learns that andrew bought a potato cannon, he asks andrew if he will sell it for $60, and andrew agrees. nick is thrilled, since he would have paid andrew up to $80 for the cannon. andrew is also delighted. determine the consumer surplus from the original purchase and the additional surplus generated by the resale of the cannon. how would a $2,000 subsidy on the purchase of a new hybrid vehicle impact the consumer surplus and producer surplus in the hybrid market? use a supply and demand diagram to illustrate your answer. does the subsidy create deadweight loss?

Answers: 1

Another question on Business

Business, 22.06.2019 12:10

Bonds often pay a coupon twice a year. for the valuation of bonds that make semiannual payments, the number of periods doubles, whereas the amount of cash flow decreases by half. using the values of cash flows and number of periods, the valuation model is adjusted accordingly. assume that a $1,000,000 par value, semiannual coupon us treasury note with three years to maturity has a coupon rate of 3%. the yield to maturity (ytm) of the bond is 7.70%. using this information and ignoring the other costs involved, calculate the value of the treasury note:

Answers: 1

Business, 22.06.2019 13:30

Tom has brought $150,000 from his pension to a new job where his employer will match 401(k) contributions dollar for dollar. each year he contributes $3,000. after seven years, how much money would tom have in his 401(k)?

Answers: 3

Business, 22.06.2019 16:30

Summarize the specific methods used by interest groups in order to influence governmental decisions making in all three branches of government. provide at least two examples from each branch.

Answers: 3

Business, 22.06.2019 19:10

The stock of grommet corporation, a u.s. company, is publicly traded, with no single shareholder owning more than 5 percent of its outstanding stock. grommet owns 95 percent of the outstanding stock of staple inc., also a u.s. company. staple owns 100 percent of the outstanding stock of clip corporation, a canadian company. grommet and clip each own 50 percent of the outstanding stock of fastener inc., a u.s. company. grommet and staple each own 50 percent of the outstanding stock of binder corporation, a u.s. company. which of these corporations form an affiliated group eligible to file a consolidated tax return?

Answers: 3

You know the right answer?

Chad paid $30 to buy a potato cannon, a cylinder that shoots potatoes hundreds of feet. he was willi...

Questions

Mathematics, 02.09.2019 10:30

Mathematics, 02.09.2019 10:30

Chemistry, 02.09.2019 10:30

English, 02.09.2019 10:30

Physics, 02.09.2019 10:30

English, 02.09.2019 10:30

Mathematics, 02.09.2019 10:30

Mathematics, 02.09.2019 10:30