Business, 07.04.2020 21:32 beautifulnation3799

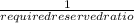

Suppose that the reserve requirement for checking deposits is 12.5 percent and that banks do not hold any excess reserves.

If the Fed sells $2 million of government bonds, the economy’s reserves Increase/Decrease bymillion, and the money supply will Increase/Decrease bymillion.

Now suppose the Fed lowers the reserve requirement to 10 percent, but banks choose to hold another 2.5 percent of deposits as excess reserves.

True or False: The money multiplier will remain unchanged.

a. True

b. False

True or False: As a result, the overall change in the money supply will remain unchanged.

a. True

b. False

Answers: 3

Another question on Business

Business, 22.06.2019 20:00

With the slowdown of business, how can starbucks ensure that the importance of leadership development does not get overlooked?

Answers: 3

Business, 22.06.2019 21:30

China white was the black market selling of ivory, in which the profit was redistributed back into the trafficking of heroin.

Answers: 3

Business, 23.06.2019 00:10

Mno corporation uses a job-order costing system with a predetermined overhead rate based on direct labor-hours. the company based its predetermined overhead rate for the current year on the following data: total estimated direct labor-hours 50,000 total estimated fixed manufacturing overhead cost $ 285,000 estimated variable manufacturing overhead per direct labor-hour $ 3.80 recently, job p123 was completed with the following characteristics: total actual direct labor-hours 20 direct materials $ 710 direct labor cost $ 500 the amount of overhead applied to job p123 is closest to:

Answers: 2

Business, 23.06.2019 07:00

To manage your money, you should -create a financial plan -organize your financial documents -spend wisely -create a budget -manage your risks -spend more than you make -learn about services offered at your bank

Answers: 3

You know the right answer?

Suppose that the reserve requirement for checking deposits is 12.5 percent and that banks do not hol...

Questions

Mathematics, 06.11.2019 04:31

Mathematics, 06.11.2019 04:31

=

=  = 8

= 8 = 8

= 8