Business, 15.04.2020 00:32 aislynrae22

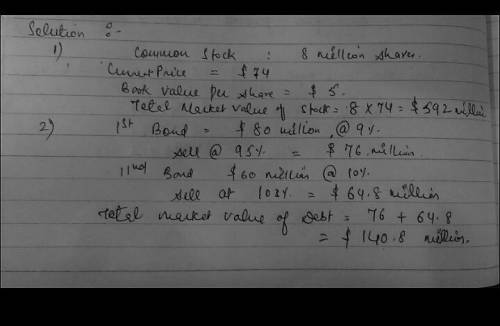

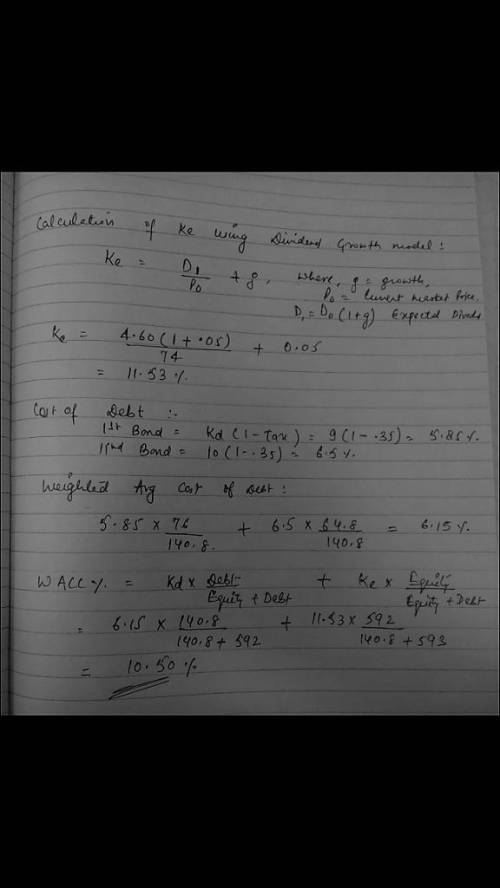

Dinklage Corp. has 8 million shares of common stock outstanding. The current share price is $74, and the book value per share is $5. The company also has two bond issues outstanding. The first bond issue has a face value of $80 million, a coupon of 9 percent, and sells for 95 percent of par. The second issue has a face value of $60 million, a coupon of 10 percent, and sells for 108 percent of par. The first issue matures in 24 years, the second in 8 years.

Suppose the most recent dividend was $4.60 and the dividend growth rate is 5 percent. Assume that the overall cost of debt is the weighted average of that implied by the two outstanding debt issues. Both bonds make semiannual payments. The tax rate is 35 percent.

What is the company's WACC?

Answers: 1

Another question on Business

Business, 22.06.2019 04:30

How does your household gain from specialization and comparative advantage? (what is produced, what is not produced yet paid to a specialist to produce? )

Answers: 3

Business, 22.06.2019 12:00

In mexico, many garment or sewing shops found they could entice many young people to work for them if they offered clean, air conditioned work areas with high-quality locker rooms to clean up in after the work day. typically, traditional garment shops had to offer to get workers to apply for the hard, repetitive, and somewhat dangerous work. a. benchmark competitive wages b.compensating differentials c. monopoly wages d. wages based on human capital development of each employee

Answers: 3

Business, 22.06.2019 12:30

Acorporation a. can use different depreciation methods for tax and financial reporting purposes b. must use the straight - line depreciation method for tax purposes and double declining depreciation method financial reporting purposes c. must use different depreciation method for tax purposes, but strictly mandated depreciation methods for financial reporting purposes d. can use straight- line depreciation method for tax purposes and macrs depreciation method financial reporting purposes

Answers: 2

Business, 22.06.2019 19:50

Managers in a firm hired to improve the firm's profitability and ultimately the shareholders' value will add to the overall costs if they pursue their own self-interests. what does this best illustrate? a. diseconomies of scale b. principal-agent problem c. experience-curveeffects d. information asymmetries

Answers: 1

You know the right answer?

Dinklage Corp. has 8 million shares of common stock outstanding. The current share price is $74, and...

Questions

Mathematics, 28.07.2019 05:10

Mathematics, 28.07.2019 05:10

Mathematics, 28.07.2019 05:10

English, 28.07.2019 05:10

History, 28.07.2019 05:10

Social Studies, 28.07.2019 05:10

English, 28.07.2019 05:10

History, 28.07.2019 05:10

Mathematics, 28.07.2019 05:10

Mathematics, 28.07.2019 05:10

English, 28.07.2019 05:10