Business, 21.04.2020 04:53 Alexmills6093

Garcon Inc. manufactures electronic products, with two operating divisions, Consumer and Commercial. Condensed divisional income statements, which involve no intracompany transfers and which include a breakdown of expenses into variable and fixed components, are as follows:

Garcon Inc.

Divisional Income Statements

For the Year Ended December 31, 20Y2

1. Consumer Division Commercial Division Total

2. Sales:

3. 14,400 units × $144 per unit $2,073,600.00 $2,073,600.00

4. 21,600 units × $275 per unit $5,940,000.00 5,940,000.00

5. Total sales $2,073,600.00 $5,940,000.00 $8,013,600.00

6. Expenses:

7. Variable:

8. 14,400 units × $104 per unit $1,497,600.00 $1,497,600.00

9. 21,600 units × $193* per unit $4,168,800.00 4,168,800.00

10. Fixed 200,000.00 520,000.00 720,000.00

11. Total expenses $1,697,600.00 $4,688,800.00 $6,386,400.00

12. Income from operations $376,000.00 $1,251,200.00 $1,627,200.00

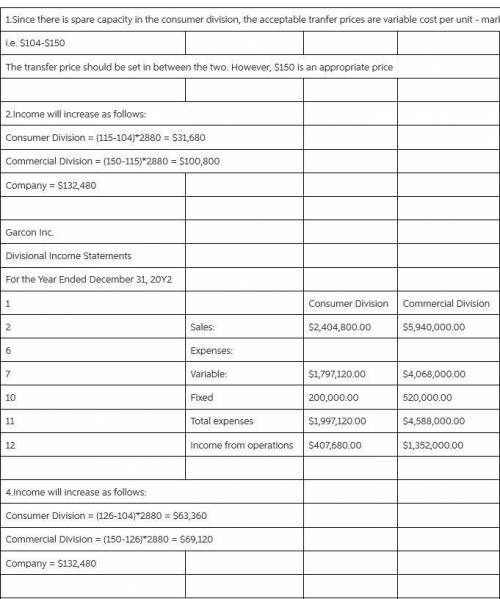

*$150 of the $193 per unit represents materials costs, and the remaining $43 per unit represents other variable conversion expenses incurred within the Commercial Division. The Consumer Division is presently producing 14,400 units out of a total capacity of 17,280 units. Materials used in producing the Commercial Division’s product are currently purchased from outside suppliers at a price of $150 per unit. The Consumer Division is able to produce the materials used by the Commercial Division. Except for the possible transfer of materials between divisions, no changes are expected in sales and expenses. Required:1. Would the market price of $150 per unit be an appropriate transfer price for Garcon Inc.? Explain.2. If the Commercial Division purchases 2,880 units from the Consumer Division, rather than externally, at a negotiated transfer price of $115 per unit, how much would the income from operations of each division and the total company income from operations increase?3. Prepare condensed divisional income statements for Garcon Inc. based on the data in Requirement 2.4. If a transfer price of $126 per unit is negotiated, how much would the income from operations of each division and the total company income from operations increase?

Answers: 3

Another question on Business

Business, 22.06.2019 09:00

Your grandmother told you a dollar doesn't go as far as it used to. she says the purchasing power of a dollar is much lesser than it used to be. explain what she means. try and use and explain terms like inflation and deflation in your answer.

Answers: 1

Business, 22.06.2019 12:50

Salaries are $4,500 per week for five working days and are paid weekly at the end of the day fridays. the end of the month falls on a thursday. the accountant for dayton company made the appropriate accrual adjustment and posted it to the ledger. the balance of salaries payable, as shown on the adjusted trial balance, will be a (assume that there was no beginning balance in the salaries payable account.)

Answers: 1

Business, 22.06.2019 20:30

Data for hermann corporation are shown below: per unit percent of sales selling price $ 125 100 % variable expenses 80 64 contribution margin $ 45 36 % fixed expenses are $85,000 per month and the company is selling 2,700 units per month. required: 1-a. how much will net operating income increase (decrease) per month if the monthly advertising budget increases by $9,000 and monthly sales increase by $20,000? 1-b. should the advertising budget be increased?

Answers: 1

Business, 23.06.2019 00:30

Three years ago, the city of recker committed to build a park and music venue by the river. it was expected to cost $2.5 million and be paid for from an additional meals tax in the community. the residents pushed back. local restaurants suffered as people ate out less or patronized restaurants in neighboring communities. the project has stalled, but the town council kept pushing it on. this spring, a flood devastated the venue. the town council appears to have suffered from bias

Answers: 3

You know the right answer?

Garcon Inc. manufactures electronic products, with two operating divisions, Consumer and Commercial....

Questions

Mathematics, 12.12.2020 15:50

Mathematics, 12.12.2020 15:50

Mathematics, 12.12.2020 15:50

Chemistry, 12.12.2020 15:50

History, 12.12.2020 15:50

Mathematics, 12.12.2020 15:50

Mathematics, 12.12.2020 15:50

Social Studies, 12.12.2020 15:50

Mathematics, 12.12.2020 15:50

Mathematics, 12.12.2020 15:50

Mathematics, 12.12.2020 15:50