Business, 15.07.2019 07:00 icantdomath4910

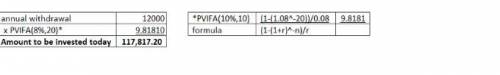

How much would howard steele need to invest today so that he may withdraw $12,000 each year for the next 20 years, assuming a rate of 8% compounded annually? (use the tables in the handbook.) $117,817.20 $454,144.00 $112,817.20 $549,144 none of these?

Answers: 1

Another question on Business

Business, 22.06.2019 07:30

Which of the following is an example of an unsought good? a. cameron purchases a new bike. b. jordan buys paper towels. c. taylor buys cupcakes from her favorite bakery. d. riley buys new windshield wipers for her car.

Answers: 3

Business, 22.06.2019 13:20

Last year, johnson mills had annual revenue of $37,800, cost of goods sold of $23,200, and administrative expenses of $6,300. the firm paid $700 in dividends and had a tax rate of 35 percent. the firm added $2,810 to retained earnings. the firm had no long-term debt. what was the depreciation expense?

Answers: 2

Business, 22.06.2019 13:40

Jacob is a member of wcc (an llc taxed as a partnership). jacob was allocated $155,000 of business income from wcc for the year. jacob’s marginal income tax rate is 37 percent. the business allocation is subject to 2.9 percent of self-employment tax and 0.9 percent additional medicare tax. (round your intermediate calculations to the nearest whole dollar a) what is the amount of tax jacob will owe on the income allocation if the income is not qualified business income? b) what is the amount of tax jacob will owe on the income allocation if the income is qualified business income (qbi) and jacob qualifies for the full qbi duduction?

Answers: 2

You know the right answer?

How much would howard steele need to invest today so that he may withdraw $12,000 each year for the...

Questions

Biology, 06.10.2019 15:30

Mathematics, 06.10.2019 15:30

History, 06.10.2019 15:30

Mathematics, 06.10.2019 15:30

Biology, 06.10.2019 15:30

Mathematics, 06.10.2019 15:30

Mathematics, 06.10.2019 15:30

History, 06.10.2019 15:30

Mathematics, 06.10.2019 15:30

History, 06.10.2019 15:30

Social Studies, 06.10.2019 15:30