Business, 15.07.2019 22:00 simrankaurdhatt

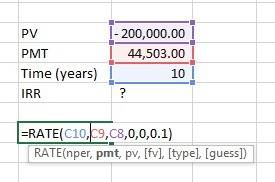

The capital budgeting director of sparrow corporation is evaluating a project that costs $200,000, is expected to last for 10 years and produces after-tax cash flows, including depreciation, of $44,503 per year. if the firm's required rate of return is 14 percent and its tax rate is 40 percent, what is the project's irr?

Answers: 1

Another question on Business

Business, 21.06.2019 19:10

Maldonia has a comparative advantage in the production of , while lamponia has a comparative advantage in the production of . suppose that maldonia and lamponia specialize in the production of the goods in which each has a comparative advantage. after specialization, the two countries can produce a total of million pounds of lemons and million pounds of coffee.

Answers: 3

Business, 22.06.2019 12:50

You are working on a bid to build two city parks a year for the next three years. this project requires the purchase of $249,000 of equipment that will be depreciated using straight-line depreciation to a zero book value over the three-year project life. ignore bonus depreciation. the equipment can be sold at the end of the project for $115,000. you will also need $18.000 in net working capital for the duration of the project. the fixed costs will be $37000 a year and the variable costs will be $148,000 per park. your required rate of return is 14 percent and your tax rate is 21 percent. what is the minimal amount you should bid per park? (round your answer to the nearest $100) (a) $214,300 (b) $214,100 (c) $212,500 (d) $208,200 (e) $208,400

Answers: 3

Business, 22.06.2019 20:00

Lillypad toys is a manufacturer of educational toys for children. six months ago, the company's research and development division came up with an idea for a unique touchscreen device that can be used to introduce children to a number of foreign languages. three months ago, the company produced a working prototype, and last month the company successfully launched its new device on the commercial market. what should lillypad's managers prepare for next? a. increased competition from imitators b. a prolonged period of uncontested success c. a sharp decline in demand for the product d. a difficult struggle to move from invention to innovation

Answers: 2

You know the right answer?

The capital budgeting director of sparrow corporation is evaluating a project that costs $200,000, i...

Questions

Social Studies, 17.08.2020 19:01

Mathematics, 17.08.2020 19:01

Mathematics, 17.08.2020 19:01

Mathematics, 17.08.2020 19:01

Mathematics, 17.08.2020 19:01

Mathematics, 17.08.2020 19:01

English, 17.08.2020 19:01

Social Studies, 17.08.2020 19:01

English, 17.08.2020 19:01

Social Studies, 17.08.2020 19:01

Physics, 17.08.2020 19:01