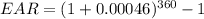

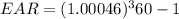

You have just purchased a new warehouse. to finance the purchase, you've arranged for a 30-year mortgage loan for 80 percent of the $4,000,000 purchase price. the monthly payment on this loan will be $18,100. what is the apr on this loan? (do not round intermediate calculations. enter your answer as a percent rounded to 2 decimal places, e. g., 32.16.) annual percentage rate % what is the ear on this loan?

Answers: 1

Another question on Business

Business, 21.06.2019 19:30

Henry crouch's law office has traditionally ordered ink refills 7070 units at a time. the firm estimates that carrying cost is 4545% of the $1212 unit cost and that annual demand is about 245245 units per year. the assumptions of the basic eoq model are thought to apply. for what value of ordering cost would its action be optimal? a) for what value of ordering cost would its action be optimal? its action would be optimal given an ordering cost of $nothing per order (round your response to two decimal place

Answers: 3

Business, 21.06.2019 20:30

Which organization was established to train the hard-core unemployed? - better business bureau- equal employment opportunity commission- environmental protection agency- affirmative action committee- national alliance of business

Answers: 1

Business, 21.06.2019 22:10

Sarah needs to complete financial aid packets. during which school year would she do this? sophomore freshman senior junior

Answers: 2

Business, 22.06.2019 08:40

Calculate the cost of each capital component—in other words, the after-tax cost of debt, the cost of preferred stock (including flotation costs), and the cost of equity (ignoring flotation costs). use both the capm method and the dividend growth approach to find the cost of equity.calculate the cost of new stock using the dividend growth approach.what is the cost of new common stock based on the capm? (hint: find the difference between re and rs as determined by the dividend growth approach and then add that difference to the capm value for rs.)assuming that gao will not issue new equity and will continue to use the same target capital structure, what is the company’s wacc? e. suppose gao is evaluating three projects with the following characteristics.each project has a cost of $1 million. they will all be financed using the target mix of long-term debt, preferred stock, and common equity. the cost of the common equity for each project should be based on the beta estimated for the project. all equity will come from reinvested earnings.equity invested in project a would have a beta of 0.5 and an expected return of 9.0%.equity invested in project b would have a beta of 1.0 and an expected return of 10.0%.equity invested in project c would have a beta of 2.0 and an expected return of 11.0%.analyze the company’s situation, and explain why each project should be accepted or rejected g

Answers: 1

You know the right answer?

You have just purchased a new warehouse. to finance the purchase, you've arranged for a 30-year mort...

Questions

Mathematics, 16.09.2020 09:01

History, 16.09.2020 09:01

English, 16.09.2020 09:01

Mathematics, 16.09.2020 09:01

Mathematics, 16.09.2020 09:01

Mathematics, 16.09.2020 09:01

Mathematics, 16.09.2020 09:01

Mathematics, 16.09.2020 09:01

Mathematics, 16.09.2020 09:01

History, 16.09.2020 09:01

Mathematics, 16.09.2020 09:01

Mathematics, 16.09.2020 09:01

Mathematics, 16.09.2020 09:01

Mathematics, 16.09.2020 09:01

Mathematics, 16.09.2020 09:01

Mathematics, 16.09.2020 09:01

Mathematics, 16.09.2020 09:01

Mathematics, 16.09.2020 09:01

Mathematics, 16.09.2020 09:01

Mathematics, 16.09.2020 09:01