Business, 09.07.2019 17:00 PineappleDevil889

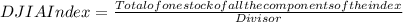

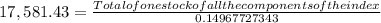

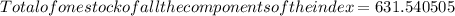

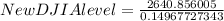

On october 28, 2015, the djia opened at 17,581.43. the divisor at that time was 0.14967727343. in october 2015, goldman sachs was the highest priced stock in the djia and cisco was the lowest. the closing price for goldman sachs on october 27, 2015, was $186.31, and the closing price for cisco was $29.05. suppose the next day the other 29 stock prices remained unchanged and goldman sachs increased 5 percent. what would the new djia level be? now assume only cisco increased by 5 percent. find the new djia level.

Answers: 1

Another question on Business

Business, 22.06.2019 06:40

Depreciation on the company's equipment for 2017 is computed to be $18,000.the prepaid insurance account had a $6,000 debit balance at december 31, 2017, before adjusting for the costs of any expired coverage. an analysis of the company's insurance policies showed that $1,100 of unexpired insurance coverage remains.the office supplies account had a $700 debit balance on december 31, 2016; and $3,480 of office supplies were purchased during the year. the december 31, 2017, physical count showed $300 of supplies available.two-thirds of the work related to $15,000 of cash received in advance was performed this period.the prepaid insurance account had a $6,800 debit balance at december 31, 2017, before adjusting for the costs of any expired coverage. an analysis of insurance policies showed that $5,800 of coverage had expired.wage expenses of $3,200 have been incurred but are not paid as of december 31, 2017.

Answers: 3

Business, 22.06.2019 22:00

The following table gives the map coordinates and the shipping loads for a set of cities that we wish to connect through a central hub.,(7,(4,(7,(6,(2,( 2,) for the location of the proposed new central hub, the coordinates should be near: x==) if the shipments from city a double, for the location of the proposed new central hub, the coordinates should be near: x==.926.865.017.21

Answers: 1

Business, 23.06.2019 02:50

Marcus nurseries inc.'s 2005 balance sheet showed total common equity of $2,050,000, which included $1,750,000 of retained earnings. the company had 100,000 shares of stock outstanding which sold at a price of $57.25 per share. if the firm had net income of $250,000 in 2006 and paid out $100,000 as dividends, what would its book value per share be at the end of 2006, assuming that it neither issued nor retired any common stock?

Answers: 1

Business, 23.06.2019 03:50

What is inventory turnover? explain the effect of a high inventory turnover during the christmas shopping season.

Answers: 1

You know the right answer?

On october 28, 2015, the djia opened at 17,581.43. the divisor at that time was 0.14967727343. in oc...

Questions

Mathematics, 13.10.2019 10:00

English, 13.10.2019 10:00

Mathematics, 13.10.2019 10:00

History, 13.10.2019 10:00

Mathematics, 13.10.2019 10:00

History, 13.10.2019 10:00

Mathematics, 13.10.2019 10:00

Chemistry, 13.10.2019 10:00

English, 13.10.2019 10:00

Mathematics, 13.10.2019 10:00

Mathematics, 13.10.2019 10:00

Health, 13.10.2019 10:00

History, 13.10.2019 10:00