Business, 03.07.2019 01:30 savidgarcia303

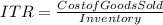

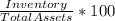

Baker mfg inc. wishes to compare its inventory turnover to those of industry​ leaders, who have turnover of about 13 times per year and 8​% of their assets invested in inventory. baker mfg. inc. net revenue ​$27 comma 500 cost of sales ​$21 comma 440 inventory ​$1 comma 230 total assets ​$16 comma 250 ​a) what is​ baker's inventory​ turnover? nothing times per year ​(round your response to two decimal​ places). ​b) what is​ baker's percent of assets committed to​ inventory? nothing​% ​(enter your response as a percentage rounded to two decimal​ places). ​c) how does​ baker's performance compare to the industry​ leaders? ▾ worse in line with industry better

Answers: 1

Another question on Business

Business, 22.06.2019 05:20

Carmen co. can further process product j to produce product d. product j is currently selling for $20 per pound and costs $15.75 per pound to produce. product d would sell for $38 per pound and would require an additional cost of $8.55 per pound to produce. what is the differential revenue of producing product d?

Answers: 2

Business, 22.06.2019 11:00

Specialization—the division of labor—enhances productivity and efficiency by a) allowing workers to take advantage of existing differences in their abilities and skills. b) avoiding the time loss involved in shifting from one production task to another. c) allowing workers to develop skills by working on one, or a limited number, of tasks. d)all of the means identified in the other answers.

Answers: 2

Business, 22.06.2019 12:20

Over the past decade, brands that were once available only to the wealthy have created more affordable product extensions, giving a far broader range of consumers a taste of the good life. jaguar, for instance, launched its x-type sedan, which starts at $30,000 and is meant for the "almost rich" consumer who aspires to live in luxury. by marketing to people who desire a luxurious lifestyle, jaguar is using:

Answers: 3

Business, 22.06.2019 20:10

Given the following information, calculate the savings ratio: liabilities = $25,000 liquid assets = $5,000 monthly credit payments = $800 monthly savings = $760 net worth = $75,000 current liabilities = $2,000 take-home pay = $2,300 gross income = $3,500 monthly expenses = $2,050 multiple choice 2.40% 3.06% 34.78% 33.79% 21.71%

Answers: 2

You know the right answer?

Baker mfg inc. wishes to compare its inventory turnover to those of industry​ leaders, who have tu...

Questions

Arts, 08.02.2021 02:20

History, 08.02.2021 02:20

English, 08.02.2021 02:20

English, 08.02.2021 02:20

Advanced Placement (AP), 08.02.2021 02:20

Mathematics, 08.02.2021 02:20

Mathematics, 08.02.2021 02:20

Mathematics, 08.02.2021 02:20

Mathematics, 08.02.2021 02:20

Mathematics, 08.02.2021 02:20

Mathematics, 08.02.2021 02:20

Mathematics, 08.02.2021 02:20

Business, 08.02.2021 02:20

Mathematics, 08.02.2021 02:20

.

.