Business, 28.11.2019 19:31 rosehayden21

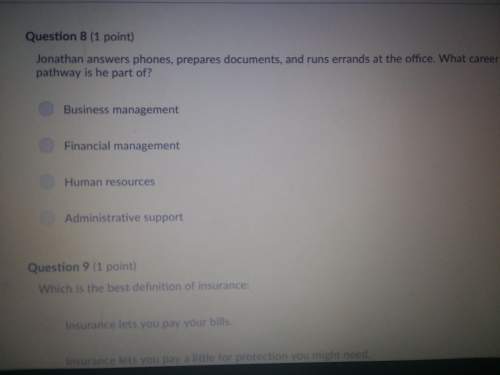

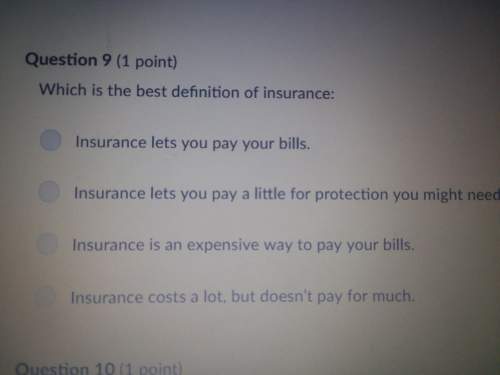

Quick im going to fail this ! will marj you so much in really need

it woild make my day

Answers: 2

Another question on Business

Business, 21.06.2019 13:50

Time value an iowa state savings bond can be converted to $750 at maturity 5 years from purchase. if the state bonds are to be competitive with u.s. savings bonds, which pay 5% annual interest (compounded annually), at what price must the state sell its bonds? assume no cash payments on savings bonds prior to redemption. ignore taxes.

Answers: 3

Business, 21.06.2019 22:40

Lincoln company has an accounting policy for internal reporting purposes whereby the costs of any research and development projects that are over 70 percent likely to succeed are capitalized and then depreciated over a five-year period with a full year of depreciation in the year of capitalization. in the current year, $400,000 was spent on project one, and it was 55 percent likely to succeed, $600,000 was spent on project two, and it was 65 percent likely to succeed, and $900,000 was spent on project three, and it was 75 percent likely to succeed. in converting the internal financial statements to external financial statements, by how much will net income for the current year have to be reduced? a. $180,000b. $380,000c. $720,000d. $900,000

Answers: 3

Business, 22.06.2019 10:40

Two assets have the following expected returns and standard deviations when the risk-free rate is 5%: asset a e(ra) = 18.5% σa = 20% asset b e(rb) = 15% σb = 27% an investor with a risk aversion of a = 3 would find that on a risk-return basis. a. only asset a is acceptable b. only asset b is acceptable c. neither asset a nor asset b is acceptable d. both asset a and asset b are acceptable

Answers: 2

Business, 22.06.2019 16:40

Job applications give employers uniform information for all employees,making it easier to

Answers: 1

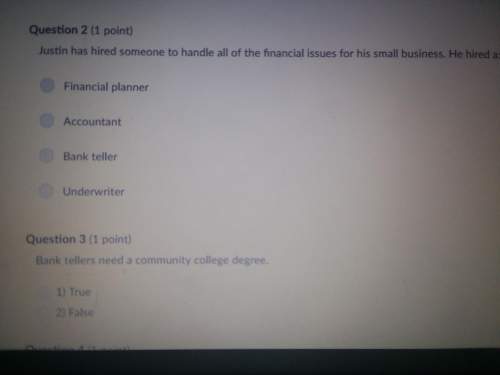

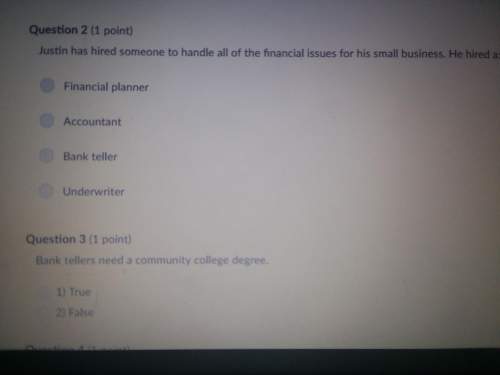

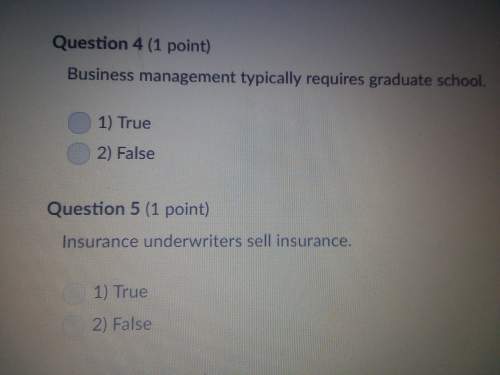

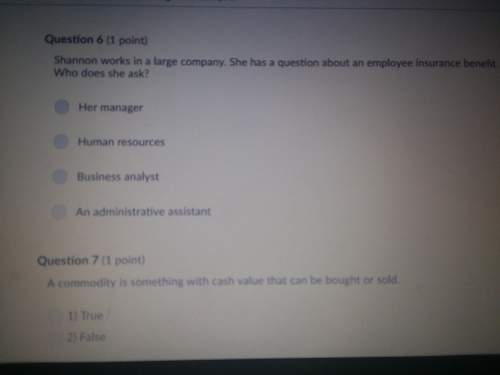

You know the right answer?

Quick im going to fail this ! will marj you so much in really need

it woild make my da...

it woild make my da...

Questions

Mathematics, 31.01.2020 14:02

Mathematics, 31.01.2020 14:02

Biology, 31.01.2020 14:02

Advanced Placement (AP), 31.01.2020 14:02

Business, 31.01.2020 14:02

Physics, 31.01.2020 14:02

Mathematics, 31.01.2020 14:02

Geography, 31.01.2020 14:02

English, 31.01.2020 14:02

History, 31.01.2020 14:02