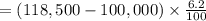

The chief executive officer earns $20,000 per month. as of may 31, her gross pay was $100,000. the tax rate for social security is 6.2% of the first $118,500 earned each calendar year and the fica tax rate for medicare is 1.45% of all earnings. the current futa tax rate is 0.6%, and the suta tax rate is 5.4%. both unemployment taxes are applied to the first $7,000 of an employee's pay. what is the amount of fica-social security withheld from this employee for the month of june?

Answers: 3

Another question on Business

Business, 22.06.2019 09:00

Afood worker has just rinsed a dish after cleaning it.what should he do next?

Answers: 2

Business, 22.06.2019 09:40

Salt corporation's contribution margin ratio is 78% and its fixed monthly expenses are $30,000. assume that the company's sales for may are expected to be $89,000. required: estimate the company's net operating income for may, assuming that the fixed monthly expenses do not change.

Answers: 1

Business, 23.06.2019 02:00

Donna and gary are involved in an automobile accident. gary initiates a lawsuit against donna by filing a complaint. if donna files a motion to dismiss, she is asserting that

Answers: 2

Business, 23.06.2019 02:30

Match each definition in column 1 with a vocabulary word from column 2." some of the entries in column 2 do not apply costs which do not change with the level of output costs which change with the level of output the change in total costs resulting from an increase in output by one unit function showing the quantities of a particular good demanded at a range of price when the quantity supplied of a good is greater than the quantity demanded when the quantity demanded for a particular good is greater than the quantity supplied the price and quantity determined in a market when the supply equals the demand when revenue exceeds costs when costs exceeds revenue output where revenue = costs

Answers: 1

You know the right answer?

The chief executive officer earns $20,000 per month. as of may 31, her gross pay was $100,000. the t...

Questions

English, 24.11.2020 14:20

English, 24.11.2020 14:20

Mathematics, 24.11.2020 14:20

Mathematics, 24.11.2020 14:20

Mathematics, 24.11.2020 14:20

Chemistry, 24.11.2020 14:20

Advanced Placement (AP), 24.11.2020 14:20

English, 24.11.2020 14:20

Mathematics, 24.11.2020 14:20

English, 24.11.2020 14:20

World Languages, 24.11.2020 14:20