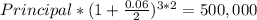

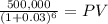

If someone offered to give you a $500,000 noninterest-bearing note that was due 5 years from today. (you will receive only one $500,000 payment three years from today) how much would you loan them if you wanted to earn an 6% annual interest rate that is compounded semiannually?

Answers: 1

Another question on Business

Business, 21.06.2019 22:30

Match the vocabulary word to the correct definition. 1. compensation 2. corporate social responsibility 3. discrimination 4. benefits 5. biodegradable a. a business’s obligation to the community and the environment b. the ability to naturally break down or decompose c. treating someone differently because of his or her race, religion,gender, sexual orientation, or disabilities d. indirect and non-cash compensation paid to employees e. the salary and other benefits for doing a job

Answers: 1

Business, 22.06.2019 06:40

10. which of the following is true regarding preretirement inflation? a. defined-benefit plans provide more inflation protection than defined-contribution plans. b. because of preretirement inflation, possible investment-related growth is increased for defined-contribution plans. c. all types of benefits are designed to cope with preretirement inflation. d. preretirement inflation is generally reflected in the increase in an employee's compensation level over a working career.

Answers: 3

Business, 22.06.2019 08:40

During january 2018, the following transactions occur: january 1 purchase equipment for $20,600. the company estimates a residual value of $2,600 and a five-year service life. january 4 pay cash on accounts payable, $10,600. january 8 purchase additional inventory on account, $93,900. january 15 receive cash on accounts receivable, $23,100 january 19 pay cash for salaries, $30,900. january 28 pay cash for january utilities, $17,600. january 30 firework sales for january total $231,000. all of these sales are on account. the cost of the units sold is $120,500. the following information is available on january 31, 2018. depreciation on the equipment for the month of january is calculated using the straight-line method. the company estimates future uncollectible accounts. at the end of january, considering the total ending balance of the accounts receivable account as shown on the general ledger tab, $4,100 is now past due (older than 90 days), while the remainder of the balance is current (less than 90 days old). the company estimates that 50% of the past due balance will be uncollectible and only 3% of the current balance will become uncollectible. record the estimated bad debt expense. accrued interest revenue on notes receivable for january. unpaid salaries at the end of january are $33,700. accrued income taxes at the end of january are $10,100

Answers: 2

You know the right answer?

If someone offered to give you a $500,000 noninterest-bearing note that was due 5 years from today....

Questions

Mathematics, 23.02.2021 21:10

Mathematics, 23.02.2021 21:10

Business, 23.02.2021 21:10

Spanish, 23.02.2021 21:10

Mathematics, 23.02.2021 21:10

Mathematics, 23.02.2021 21:10

Biology, 23.02.2021 21:10