Business, 17.07.2019 01:10 dlatricewilcoxp0tsdw

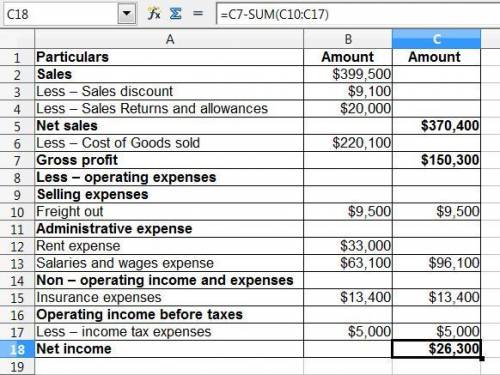

Presented below is information for carla vista co. for the month of january 2017. cost of goods sold $220,100 rent expense $33,000 freight-out 9,500 sales discounts 9,100 insurance expense 13,400 sales returns and allowances 20,000 salaries and wages expense 63,100 sales revenue 399,500 income tax expense 5,000 other comprehensive income (net of $400 tax) 2,000 . prepare an income statement using the multi-step format.

Answers: 1

Another question on Business

Business, 21.06.2019 20:50

Last year, western corporation had sales of $5 million, cost of goods sold of $3 million, operating expenses of $175,000 and depreciation of $125,000. the firm received $40,000 in dividend income and paid $200,000 in interest on loans. also, western sold stock during the year, receiving a $40,000 gain on stock owned 6 years, but losing $60,000 on stock owned 4 years. what is the firm's tax liability?

Answers: 2

Business, 22.06.2019 11:20

Ardmore farm and seed has an inventory dilemma. they have been selling a brand of very popular insect spray for the past year. they have never really analyzed the costs incurred from ordering and holding the inventory and currently fave a large stock of the insecticide in the warehouse. they estimate that it costs $25 to place an order, and it costs $0.25 per gallon to hold the spray. the annual requirements total 80,000 gallons for a 365 day year.a. assuming that 10,000 gallons are ordered each time an order is placed, estimate the annual inventory costs.b. calculate the eoq.c. given the eoq calculated in part b., how many orders should be placed and what is the average inventory balance? d. if it takes seven days to receive an order from suppliers, at what inventory level should ardmore place another order?

Answers: 2

Business, 22.06.2019 11:30

On average, someone with a bachelor's degree is estimated to earn times more than someone with a high school diploma. a)1.2 b)1.4 c)1.6 d)1.8

Answers: 1

Business, 22.06.2019 12:10

Lambert manufacturing has $100,000 to invest in either project a or project b. the following data are available on these projects (ignore income taxes.): project a project b cost of equipment needed now $100,000 $60,000 working capital investment needed now - $40,000 annual cash operating inflows $40,000 $35,000 salvage value of equipment in 6 years $10,000 - both projects will have a useful life of 6 years and the total cost approach to net present value analysis. at the end of 6 years, the working capital investment will be released for use elsewhere. lambert's required rate of return is 14%. the net present value of project b is:

Answers: 2

You know the right answer?

Presented below is information for carla vista co. for the month of january 2017. cost of goods sold...

Questions

Geography, 05.05.2020 02:59

Chemistry, 05.05.2020 02:59

Mathematics, 05.05.2020 02:59

Mathematics, 05.05.2020 02:59

History, 05.05.2020 02:59

English, 05.05.2020 02:59

Mathematics, 05.05.2020 02:59

Mathematics, 05.05.2020 02:59

English, 05.05.2020 02:59

Mathematics, 05.05.2020 02:59