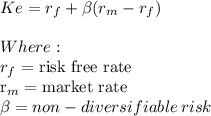

Linke motors has a beta of 1.30, the t-bill rate is 3.00%, and the t-bond rate is 6.5%. the annual return on the stock market during the past 3 years was 15.00%, but investors expect the annual future stock market return to be 13.00%. based on the sml, what is the firm's required return?

Answers: 2

Another question on Business

Business, 22.06.2019 16:30

Which of the following has the largest impact on opportunity cost

Answers: 2

Business, 22.06.2019 18:30

Health insurance protects you if you experience any of the following except: a: if you have to be hospitalized b: if you damage someone's property c: if you need to visit a clinic d: if you can't work because of illness

Answers: 2

Business, 22.06.2019 20:30

When many scrum teams are working on the same product, should all of their increments be integrated every sprint?

Answers: 3

Business, 23.06.2019 00:30

Listed below are several transactions that took place during the first two years of operations for the law firm of pete, pete, and roy.year 1 year 2amounts billed to clients for services rendered $ 170,000 $ 220,000 cash collected from clients 160,000 190,000 cash disbursements salaries paid to employees for services rendered during the year 90,000 100,000 utilities 30,000 40,000 purchase of insurance policy 60,000 0 in addition, you learn that the company incurred utility costs of $35,000 in year 1, that there were no liabilities at the end of year 2, no anticipated bad debts on receivables, and that the insurance policy covers a three-year period.required: 1. & 3. calculate the net operating cash flow for years 1 and 2 and determine the amount of receivables from clients that the company would show in its year 1 and year 2 balance sheets prepared according to the accrual accounting model.2. prepare an income statement for each year according to the accrual accounting model.

Answers: 1

You know the right answer?

Linke motors has a beta of 1.30, the t-bill rate is 3.00%, and the t-bond rate is 6.5%. the annual r...

Questions

Biology, 04.08.2019 18:30

History, 04.08.2019 18:30

History, 04.08.2019 18:30

Biology, 04.08.2019 18:30

History, 04.08.2019 18:30

Business, 04.08.2019 18:30

History, 04.08.2019 18:30

Biology, 04.08.2019 18:30

Chemistry, 04.08.2019 18:30

History, 04.08.2019 18:30

History, 04.08.2019 18:30

Physics, 04.08.2019 18:30

Computers and Technology, 04.08.2019 18:30

Social Studies, 04.08.2019 18:30

History, 04.08.2019 18:30