Business, 17.07.2019 22:10 gabbypittman20

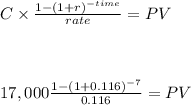

Sister pools sells outdoor swimming pools and currently has an aftertax cost of capital of 11.6 percent. al's construction builds and sells water features and fountains and has an aftertax cost of capital of 10.3 percent. sister pools is considering building and selling its own water features and fountains. the sales manager of sister pools estimates that the water features and fountains would produce 20 percent of the firm's future total sales. the initial cash outlay for this project would be $85,000. the expected net cash inflows are $17,000 a year for 7 years. what is the net present value of the sister pools project?

Answers: 1

Another question on Business

Business, 22.06.2019 17:40

Adamson company manufactures four lines of garden tools. as a result of an activity analysis, the accounting department has identified eight activity cost pools. each of the product lines is produced in large batches, with the whole plant devoted to one product at a time. classify each of the following activities or costs as either unit-level, batch-level, product-level, or facility-level. activities (a) machining parts. (b) product design. (c) plant maintenance. (d) machine setup. (e) assembling parts. (f) purchasing raw materials. (g) property taxes. (h) painting.

Answers: 2

Business, 22.06.2019 22:40

Southeastern oklahoma state university's business program has the facilities and faculty to handle an enrollment of 2,000 new students per semester. however, in an effort to limit class sizes to a "reasonable" level (under 200 generally), southeastern's dean, holly lutze, placed a ceiling on enrollment of 1,600 new students. although there was ample demand for business courses last semester, conflicting schedules allowed only 1,440 new students to take business courses.the utilization rate for southeastern=%the efficiency rate for southeastern=%

Answers: 3

Business, 23.06.2019 11:20

In march 2012, the state of california started requiring that all packaging for food and drink with the additive 4-methylimidazole (4-mi) be clearly labeled with a cancer warning. because of this, both pepsi and coke changed their formula to eliminate 4-mi as an ingredient. if pepsi and coke did not change their formula, holding all else constant, what would have happened to the demand for these goods, assuming pepsi and coke were in a competitive market? a. the demand curve for both pepsi and coke would have shifted to the right, causing the price of both products to decrease and the profits for the companies to fall. b. the demand curve for pepsi and coke would have remained unchanged, but the price of both products would have decreased and the profits for the companies would have fallen. c. the demand curve for pepsi and coke would have decreased, but the prices and profits would not have changed. d. the demand curve for only one of them would change because pepsi and coke are substitutes. e. the demand curve for pepsi and coke would have shifted to the left, causing the price of both products to decrease and the profits for both companies to fall.

Answers: 3

Business, 23.06.2019 14:20

Suppose a mutual fund qualifies as having moderate risk if the standard deviation of its monthly rate of return is less than 3%. a mutual-fund rating agency randomly selects 27 months and determines the rate of return for a certain fund. the standard deviation of the rate of return is computed to be 2.19%. is there sufficient evidence to conclude that the fund has moderate risk at the alpha equals 0.05 level of significance? a normal probability plot indicates that the monthly rates of return are normally distributed.

Answers: 2

You know the right answer?

Sister pools sells outdoor swimming pools and currently has an aftertax cost of capital of 11.6 perc...

Questions

Mathematics, 22.09.2021 17:30

History, 22.09.2021 17:30

English, 22.09.2021 17:30

Mathematics, 22.09.2021 17:30

English, 22.09.2021 17:30

Mathematics, 22.09.2021 17:30

English, 22.09.2021 17:30

Chemistry, 22.09.2021 17:30

Health, 22.09.2021 17:30

Mathematics, 22.09.2021 17:30