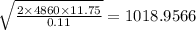

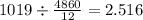

babble, inc., buys 405 blank cassette tapes per month for use in producing foreign language courseware. the ordering cost is $11.75. holding cost is $0.11 per cassette per year. a. how many tapes should babble order at a time? babble should order nothing tapes at a time. (enter your response rounded to the nearest whole number.) b. what is the time between orders? the time between orders is nothing months. (enter your response rounded to one decimal place.)

Answers: 3

Another question on Business

Business, 21.06.2019 17:00

The risk-free rate is 7% and the expected rate of return on the market portfolio is 11%. a. calculate the required rate of return on a security with a beta of 1.92. (do not round intermediate calculations. enter your answer as a percent rounded to 2 decimal places.) b. if the security is expected to return 15%, is it overpriced or underpriced?

Answers: 2

Business, 21.06.2019 21:00

Upscale hotels in the united states recently cut their prices by 20 percent in an effort to bolster dwindling occupancy rates among business travelers. a survey performed by a major research organization indicated that businesses are wary of current economic conditions and are now resorting to electronic media, such as the internet and the telephone, to transact business. assume a company's budget permits it to spend $5,000 per month on either business travel or electronic media to transact business. graphically illustrate how a 20 percent decline in the price of business travel would impact this company's budget set if the price of business travel was initially $1,000 per trip and the price of electronic media was $500 per hour. suppose that, after the price of business travel drops, the company issues a report indicating that its marginal rate of substitution between electronic media and business travel is 1. is the company allocating resources efficiently? explain.

Answers: 1

Business, 22.06.2019 10:40

Two assets have the following expected returns and standard deviations when the risk-free rate is 5%: asset a e(ra) = 18.5% σa = 20% asset b e(rb) = 15% σb = 27% an investor with a risk aversion of a = 3 would find that on a risk-return basis. a. only asset a is acceptable b. only asset b is acceptable c. neither asset a nor asset b is acceptable d. both asset a and asset b are acceptable

Answers: 2

Business, 22.06.2019 12:00

Need today! will get brainliest for right answer! compare and contrast absolute advantage and comparative advantage.

Answers: 1

You know the right answer?

babble, inc., buys 405 blank cassette tapes per month for use in producing foreign language coursewa...

Questions

Arts, 08.01.2021 21:10

SAT, 08.01.2021 21:10

Mathematics, 08.01.2021 21:10

Mathematics, 08.01.2021 21:10

Business, 08.01.2021 21:10

Mathematics, 08.01.2021 21:10

Mathematics, 08.01.2021 21:10

Mathematics, 08.01.2021 21:10

Mathematics, 08.01.2021 21:10

Social Studies, 08.01.2021 21:10

Health, 08.01.2021 21:10

Mathematics, 08.01.2021 21:10