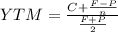

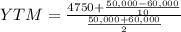

During recessionary periods, bonds that were issued many years ago have a higher coupon rate than currently issued bonds. therefore, they may sell at a premium, a price higher than their face value, because of currently low coupon rates. a $50,000 bond that was issued 15 years ago is for sale for $60,000. what rate of return per year will a purchaser make if the bond coupon rate is 19% per year payable semi-annually, and the bond is due 5 years from now?

Answers: 3

Another question on Business

Business, 22.06.2019 11:10

An insurance company estimates the probability of an earthquake in the next year to be 0.0015. the average damage done to a house by an earthquake it estimates to be $90,000. if the company offers earthquake insurance for $150, what is company`s expected value of the policy? hint: think, is it profitable for the insurance company or not? will they gain (positive expected value) or lose (negative expected value)? if the expected value is negative, remember to show "-" sign. no "+" sign needed for the positive expected value

Answers: 2

Business, 22.06.2019 14:20

Your uncle borrows $53,000 from the bank at 11 percent interest over the nine-year life of the loan. use appendix d for an approximate answer but calculate your final answer using the formula and financial calculator methods. what equal annual payments must be made to discharge the loan, plus pay the bank its required rate of interest

Answers: 1

Business, 22.06.2019 17:40

Take it all away has a cost of equity of 11.11 percent, a pretax cost of debt of 5.36 percent, and a tax rate of 40 percent. the company's capital structure consists of 67 percent debt on a book value basis, but debt is 33 percent of the company's value on a market value basis. what is the company's wacc

Answers: 2

Business, 23.06.2019 01:00

Why does the downward-sloping production possibilities curve imply that factors of production are scarce?

Answers: 1

You know the right answer?

During recessionary periods, bonds that were issued many years ago have a higher coupon rate than cu...

Questions

Mathematics, 05.05.2020 09:03

Social Studies, 05.05.2020 09:03

Computers and Technology, 05.05.2020 09:03

English, 05.05.2020 09:03

History, 05.05.2020 09:03

Mathematics, 05.05.2020 09:03

Mathematics, 05.05.2020 09:03

Mathematics, 05.05.2020 09:03