Business, 22.07.2019 20:30 corrineikerd

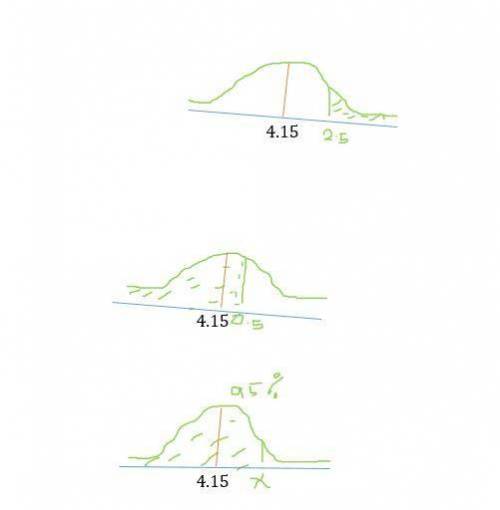

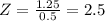

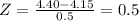

Net interest margin—often referred to as spread—is the difference between the rate banks pay on deposits and the rate they charge for loans. suppose that the net interest margins for all u. s. banks are normally distributed with a mean of 4.15 percent and a standard deviation of .5 percent. (a) find the probability that a randomly selected u. s. bank will have a net interest margin that exceeds 5.40 percent. (round answer to 4 decimal places.) p (b) find the probability that a randomly selected u. s. bank will have a net interest margin less than 4.40 percent. (round answer to 4 decimal places.) p (c) a bank wants its net interest margin to be less than the net interest margins of 95 percent of all u. s. banks. where should the bank’s net interest margin be set? (round the z value to 3 decimal places. round answer to 4 decimal places.)

Answers: 1

Another question on Business

Business, 21.06.2019 18:20

When someone buys a fourth television for his or her house, what is the result? a. there's a decrease in the marginal utility of the television. b. the increase in demand brings leads to higher prices for televisions. c. the production of televisions becomes more efficient. d. there's a rise in the opportunity cost of buying other goods.

Answers: 2

Business, 22.06.2019 03:30

Joe said “your speech was really great, i loved it.” his criticism lacks which component of effective feedback? a) he did not recognize his ethical obligations b) he did not focus on behavior c) he did not stress the positive d) he did not offer any specifics

Answers: 2

Business, 22.06.2019 11:20

Stock a has a beta of 1.2 and a standard deviation of 20%. stock b has a beta of 0.8 and a standard deviation of 25%. portfolio p has $200,000 consisting of $100,000 invested in stock a and $100,000 in stock b. which of the following statements is correct? (assume that the stocks are in equilibrium.) (a) stock b has a higher required rate of return than stock a. (b) portfolio p has a standard deviation of 22.5%. (c) portfolio p has a beta equal to 1.0. (d) more information is needed to determine the portfolio's beta. (e) stock a's returns are less highly correlated with the returns on most other stocks than are b's returns.

Answers: 3

Business, 22.06.2019 12:20

In terms of precent, beer has more alcohol than whiskey true or false

Answers: 1

You know the right answer?

Net interest margin—often referred to as spread—is the difference between the rate banks pay on depo...

Questions

English, 17.07.2019 02:30

Computers and Technology, 17.07.2019 02:30

History, 17.07.2019 02:30

Mathematics, 17.07.2019 02:30

Mathematics, 17.07.2019 02:30

History, 17.07.2019 02:30

History, 17.07.2019 02:30

Mathematics, 17.07.2019 02:30

Mathematics, 17.07.2019 02:30

Social Studies, 17.07.2019 02:30

Mathematics, 17.07.2019 02:30

The net interest margin of 4.40 percent is 0.5 standard deviation above the mean.

The net interest margin of 4.40 percent is 0.5 standard deviation above the mean.