Business, 23.07.2019 04:30 alexlee202204

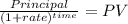

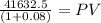

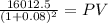

The dart company is financed entirely with equity. the company is considering a loan of $1.83 million. the loan will be repaid in equal principal installments over the next two years, and it has an interest rate of 8 percent. the company’s tax rate is 35 percent. according to mm proposition i with taxes, what would be the increase in the value of the company after the loan? (enter your answer in dollars, not millions of dollars, e. g., 1,234,567. do not round intermediate calculations and round your answer to 2 decimal places, e. g., 32.16.)

Answers: 2

Another question on Business

Business, 22.06.2019 05:30

In most states, a licensee must provide a(n) of any existing agency relationships to all parties

Answers: 3

Business, 22.06.2019 19:50

Aproperty title search firm is contemplating using online software to increase its search productivity. currently an average of 40 minutes is needed to do a title search. the researcher cost is $2 per minute. clients are charged a fee of $400. company a's software would reduce the average search time by 10 minutes, at a cost of $3.50 per search. company b's software would reduce the average search time by 12 minutes at a cost of $3.60 per search. which option would have the higher productivity in terms of revenue per dollar of input?

Answers: 1

Business, 23.06.2019 03:00

If joe to go decides to produce its coffee beans domestically and sell them in india through a local retailer, this would be an example of

Answers: 2

You know the right answer?

The dart company is financed entirely with equity. the company is considering a loan of $1.83 millio...

Questions

Health, 05.05.2020 13:40

Mathematics, 05.05.2020 13:40

Mathematics, 05.05.2020 13:41

Mathematics, 05.05.2020 13:41

English, 05.05.2020 13:41

Social Studies, 05.05.2020 13:41

History, 05.05.2020 13:41