Business, 24.07.2019 22:20 cadenbukvich9923

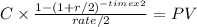

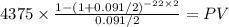

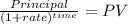

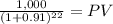

Assume the city of tulsa, oklahoma issued bonds 3 years ago as follows: 8.75% $150 million at 8.75%. the original maturity was 25 years, par value is $1,000, with interest paid annually. the original credit rating was a1/a+ by moody's and s& p, respectively. if the rating agencies downgrade the credit ratings to a3/a-, investors will want a 9.10% return. what would happen to the price per bond if that happens today? (6 decimal places).

Answers: 1

Another question on Business

Business, 22.06.2019 11:40

Define the marginal rate of substitution between two goods (x and y). if a consumer’s preferences are given by u(x,y) = x3/4y1/4, compute the consumer’s marginal rate of substitution as a function of x and y. calculate the mrs if the consumer has chosen to consumer 48 units of x and 16 units of y. show your work. (use the back of the page if necessary.

Answers: 3

Business, 22.06.2019 14:30

If a product goes up in price, and the demand for it drops, that product's demand is a. elastic b. inelastic c. stable d. fixed select the best answer from the choices provided

Answers: 1

Business, 22.06.2019 18:30

Amanufacturer has paid an engineering firm $200,000 to design a new plant, and it will cost another $2 million to build the plant. in the meantime, however, the manufacturer has learned of a foreign company that offers to build an equivalent plant for $2,100,000. what should the manufacturer do?

Answers: 1

Business, 22.06.2019 23:00

The sign at the bank reads, "wait here for the first available teller," suggests the use of a waiting line system.a. multiple server, single phaseb. random server, single phasec. single server, multiphased. multiple server, multiphasee. dynamic server, single phase

Answers: 2

You know the right answer?

Assume the city of tulsa, oklahoma issued bonds 3 years ago as follows: 8.75% $150 million at 8.75%...

Questions

Computers and Technology, 05.05.2020 17:39

Mathematics, 05.05.2020 17:39

English, 05.05.2020 17:39

Computers and Technology, 05.05.2020 17:39

Mathematics, 05.05.2020 17:39

Biology, 05.05.2020 17:39

Mathematics, 05.05.2020 17:39

Health, 05.05.2020 17:39