Business, 30.07.2019 18:10 amusgrave9175

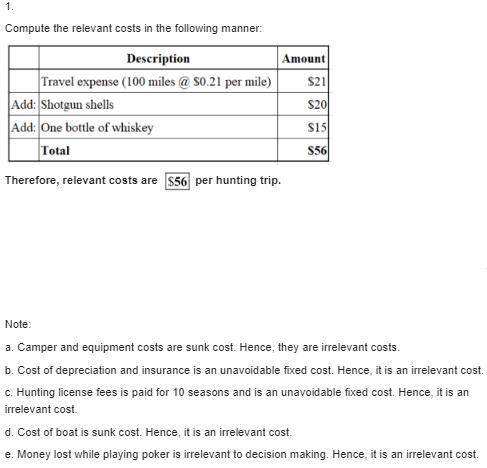

Bill has just returned from a duck hunting trip. he brought home eight ducks. bill’s friend, john, disapproves of duck hunting, and to discourage bill from further hunting, john presented him with the following cost estimate per duck: camper and equipment: cost, $17,000; usable for eight seasons; 14 hunting trips per season $ 152 travel expense (pickup truck): 100 miles at $0.38 per mile (gas, oil, and tires—$0.28 per mile; depreciation and insurance—$0.10 per mile) 38 shotgun shells (two boxes per hunting trip) 30 boat: cost, $2,480, usable for eight seasons; 14 hunting trips per season 22 hunting license: cost, $30 for the season; 14 hunting trips per season 2 money lost playing poker: loss, $28 (bill plays poker every weekend whether he goes hunting or stays at home) 28 bottle of whiskey: cost, $20 per hunting trip (used to ward off the cold) 20 total cost $ 292 cost per duck ($292 ÷ 8 ducks) $ 36 required: 1. assuming the duck hunting trip bill has just completed is typical, what costs are relevant to a decision as to whether bill should go duck hunting again this season? 2. suppose bill gets lucky on his next hunting trip and shoots 14 ducks using the same amount of shotgun shells he used on his previous hunting trip to bag 8 ducks. how much would it have cost him to shoot the last six ducks

Answers: 1

Another question on Business

Business, 22.06.2019 11:20

In 2000, campbell soup company launched an ad campaign that showed prepubescent boys offering soup to prepubescent girls. the girls declined because they were concerned about their calorie intake. the boys explained that “lots of campbell’s soups are low in calories,” which made them ok for the girls to eat. the ads were pulled after parents expressed concern. why were parents worried? i

Answers: 2

Business, 22.06.2019 16:00

Arnold rossiter is a 40-year-old employee of the barrington company who will retire at age 60 and expects to live to age 75. the firm has promised a retirement income of $20,000 at the end of each year following retirement until death. the firm's pension fund is expected to earn 7 percent annually on its assets and the firm uses 7% to discount pension benefits. what is barrington's annual pension contribution to the nearest dollar for mr. rossiter? (assume certainty and end-of-year cash flows.)

Answers: 2

Business, 22.06.2019 22:50

Wendy made her career planning timeline in 2010. in what year should wendy's timeline start? a. 2013 o b. 2012 oc. 2010 o d. 2011

Answers: 2

Business, 22.06.2019 23:00

The discussion of the standards for selection of peanuts that will be used in m& ms and the placement of the m& m logo on the candies speaks to which building block of a sustainable competitive advantage:

Answers: 1

You know the right answer?

Bill has just returned from a duck hunting trip. he brought home eight ducks. bill’s friend, john, d...

Questions

History, 16.04.2021 01:00

English, 16.04.2021 01:00

English, 16.04.2021 01:00

Mathematics, 16.04.2021 01:00

Mathematics, 16.04.2021 01:00

English, 16.04.2021 01:00

Biology, 16.04.2021 01:00

Chemistry, 16.04.2021 01:00