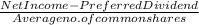

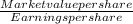

Daniel corporation had net income for 2018 of $ 74 comma 000. daniel had 12 comma 000 shares of common stock outstanding at the beginning of the year and 17 comma 000 shares of common stock outstanding at the end of the year. there were 12 comma 000 shares of preferred stock outstanding all year. during 2018, daniel declared and paid preferred dividends of $ 25 comma 000. on december 31, 2018, the market price of daniel's common stock is $ 46.00 per share and the market price of its preferred stock is $ 68.00 per share. what is daniel's price/earnings ratio at december 31, 2018? (round any intermediate calculations and your fin

Answers: 1

Another question on Business

Business, 21.06.2019 19:40

Uppose stanley's office supply purchases 50,000 boxes of pens every year. ordering costs are $100 per order and carrying costs are $0.40 per box. moreover, management has determined that the eoq is 5,000 boxes. the vendor now offers a quantity discount of $0.20 per box if the company buys pens in order sizes of 10,000 boxes. determine the before-tax benefit or loss of accepting the quantity discount. (assume the carrying cost remains at $0.40 per box whether or not the discount is taken.)

Answers: 1

Business, 21.06.2019 21:30

Asavings account that pays interest every 3 months is said to have a interest period

Answers: 1

Business, 22.06.2019 19:50

Statistical process control charts: a. indicate to the operator the true quality of material leaving the process. b. display upper and lower limits for process variables or attributes and signal when a process is no longer in control. c. indicate to the process operator the average outgoing quality of each lot. d. display the measurements on every item being produced. e. are a graphic way of classifying problems by their level of importance, often referred to as the 80-20 rule.

Answers: 2

Business, 22.06.2019 20:00

Harry is 25 years old with a 1.55 rating factor for his auto insurance. if his annual base premium is $1,012, what is his total premium? $1,568.60 $2,530 $1,582.55 $1,842.25

Answers: 1

You know the right answer?

Daniel corporation had net income for 2018 of $ 74 comma 000. daniel had 12 comma 000 shares of comm...

Questions

Mathematics, 22.11.2019 08:31

Mathematics, 22.11.2019 08:31

Mathematics, 22.11.2019 08:31

Mathematics, 22.11.2019 08:31

Mathematics, 22.11.2019 08:31

Mathematics, 22.11.2019 08:31

Mathematics, 22.11.2019 08:31

Mathematics, 22.11.2019 08:31

Mathematics, 22.11.2019 08:31

Biology, 22.11.2019 08:31

Mathematics, 22.11.2019 08:31