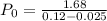

The brown company just announced that they will be increasing their annual dividend to $1.68 next year and that future dividends will be increased by 2.5% annually. how much would you be willing to pay for one share of the brown company stock if you require a 12% rate of return?

Answers: 3

Another question on Business

Business, 22.06.2019 12:50

Two products, qi and vh, emerge from a joint process. product qi has been allocated $34,300 of the total joint costs of $55,000. a total of 2,900 units of product qi are produced from the joint process. product qi can be sold at the split-off point for $11 per unit, or it can be processed further for an additional total cost of $10,900 and then sold for $13 per unit. if product qi is processed further and sold, what would be the financial advantage (disadvantage) for the company compared with sale in its unprocessed form directly after the split-off point?

Answers: 2

Business, 22.06.2019 15:30

Uknow what i love about i ask a dumb question it is immediately answered but when i ask a real question it take like an hour to get answered

Answers: 2

Business, 22.06.2019 17:00

Afinancing project has an initial cash inflow of $42,000 and cash flows of −$15,600, −$22,200, and −$18,000 for years 1 to 3, respectively. the required rate of return is 13 percent. what is the internal rate of return? should the project be accepted?

Answers: 1

Business, 22.06.2019 17:30

An essential element of being receptive to messages is to have an open mind true or false

Answers: 2

You know the right answer?

The brown company just announced that they will be increasing their annual dividend to $1.68 next ye...

Questions

Social Studies, 16.09.2019 14:10

English, 16.09.2019 14:10

History, 16.09.2019 14:10

History, 16.09.2019 14:10

History, 16.09.2019 14:10

Mathematics, 16.09.2019 14:10

Biology, 16.09.2019 14:10

Mathematics, 16.09.2019 14:10

Mathematics, 16.09.2019 14:10

Chemistry, 16.09.2019 14:10

Mathematics, 16.09.2019 14:10

Biology, 16.09.2019 14:10

Social Studies, 16.09.2019 14:10

= Current price of share

= Current price of share = Dividend to be paid at year end = $1.68 as provided,

= Dividend to be paid at year end = $1.68 as provided, = Cost of equity or expected return on equity = 12% as provided,

= Cost of equity or expected return on equity = 12% as provided,