Business, 18.08.2019 05:20 1963038660

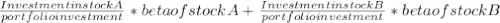

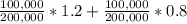

Stock a has a beta of 1.2 and a standard deviation of 20%. stock b has a beta of 0.8 and a standard deviation of 25%. portfolio p has $200,000 consisting of $100,000 invested in stock a and $100,000 in stock b. which of the following statements is correct? (assume that the stocks are in equilibrium.) a. portfolio p has a standard deviation of 22.5%. b. portfolio p has a beta of 1.0. c. stock b has a higher required rate of return than stock a. d. more information is needed to determine the portfolio's beta. e. stock a's returns are less highly correlated with the returns on most other stocks than are b's returns.

Answers: 2

Another question on Business

Business, 22.06.2019 14:30

In our daily interactions we can find ourselves listening to other people solely for the purpose of finding weakness in their positions so that we can formulate a convincing response. select one: true false

Answers: 1

Business, 22.06.2019 19:30

Consider the following two projects. both have costs of $5,000 in year 1. project 1 provides benefits of $2,000 in each of the first four years only. the second provides benefits of $2,000 for each of years 6 to 10 only. compute the net benefits using a discount rate of 6 percent. repeat using a discount rate of 12 percent. what can you conclude from this exercise?

Answers: 3

Business, 22.06.2019 23:00

Sailcloth & more currently produces boat sails and is considering expanding its operations to include awnings for homes and travel trailers. the company owns land beside its current manufacturing facility that could be used for the expansion. the company bought this land 5 years ago at a cost of $319,000. at the time of purchase, the company paid $24,000 to level out the land so it would be suitable for future use. today, the land is valued at $295,000. the company has some unused equipment that it currently owns valued at $38,000. this equipment could be used for producing awnings if $12,000 is spent for equipment modifications. other equipment costing $490,000 will also be required. what is the amount of the initial cash flow for this expansion project?

Answers: 2

Business, 22.06.2019 23:30

An outside supplier has offered to sell talbot similar wheels for $1.25 per wheel. if the wheels are purchased from the outside supplier, $15,000 of annual fixed overhead could be avoided and the facilities now being used could be rented to another company for $45,000 per year. direct labor is a variable cost. if talbot chooses to buy the wheel from the outside supplier, then annual net operating income would:

Answers: 1

You know the right answer?

Stock a has a beta of 1.2 and a standard deviation of 20%. stock b has a beta of 0.8 and a standard...

Questions

History, 18.01.2021 18:20

Mathematics, 18.01.2021 18:20

Mathematics, 18.01.2021 18:20

Mathematics, 18.01.2021 18:20

English, 18.01.2021 18:20

English, 18.01.2021 18:30

Mathematics, 18.01.2021 18:30

Mathematics, 18.01.2021 18:30

Biology, 18.01.2021 18:30

Mathematics, 18.01.2021 18:30

Arts, 18.01.2021 18:30

Mathematics, 18.01.2021 18:30

Mathematics, 18.01.2021 18:30