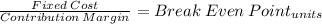

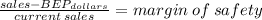

Mary willis is the advertising manager for bargain shoe store. she is currently working on a major promotional campaign. her ideas include the installation of a new lighting system and increased display space that will add $54,600 in fixed costs to the $399,000 currently spent. in addition, mary is proposing that a 5% price decrease ($60 to $57) will produce a 20% increase in sales volume (20,000 to 24,000). variable costs will remain at $36 per pair of shoes. management is impressed with mary’s ideas but concerned about the effects that these changes will have on the break-even point and the margin of safety. compute the current break-even point in units, and compare it to the break-even point in units if mary’s ideas are used. (round answers to 0 decimal places, e. g. 1,225.) current break-even point pairs of shoes new break-even point pairs of shoes

Answers: 1

Another question on Business

Business, 22.06.2019 01:40

Costs of production that do not change when output changes.question 17 options: total revenuefixed incometotal costfixed cost

Answers: 1

Business, 22.06.2019 03:30

Diversified semiconductors sells perishable electronic components. some must be shipped and stored in reusable protective containers. customers pay a deposit for each container received. the deposit is equal to the container’s cost. they receive a refund when the container is returned. during 2018, deposits collected on containers shipped were $856,000. deposits are forfeited if containers are not returned within 18 months. containers held by customers at january 1, 2018, represented deposits of $587,000. in 2018, $811,000 was refunded and deposits forfeited were $41,000. required: 1. prepare the appropriate journal entries for the deposits received and returned during 2018. 2. determine the liability for refundable deposits to be reported on the december 31, 2018, balance sheet.

Answers: 1

Business, 22.06.2019 13:10

A4-year project has an annual operating cash flow of $59,000. at the beginning of the project, $5,000 in net working capital was required, which will be recovered at the end of the project. the firm also spent $23,900 on equipment to start the project. this equipment will have a book value of $5,260 at the end of the project, but can be sold for $6,120. the tax rate is 35 percent. what is the year 4 cash flow?

Answers: 2

Business, 22.06.2019 15:50

Evaluate a real situation between two economic actors; it could be any scenario: two competing businesses, two countries in negotiations, two kids trading baseball cards, you and another person involved in an exchange or anything else. use game theory to analyze the situation and the outcome (or potential outcome). be sure to explain the incentives, benefits and risks each face.

Answers: 1

You know the right answer?

Mary willis is the advertising manager for bargain shoe store. she is currently working on a major p...

Questions

History, 20.08.2019 07:00

History, 20.08.2019 07:00

History, 20.08.2019 07:00

Mathematics, 20.08.2019 07:00

Mathematics, 20.08.2019 07:00

Spanish, 20.08.2019 07:00

History, 20.08.2019 07:00

Mathematics, 20.08.2019 07:00

Mathematics, 20.08.2019 07:00

Geography, 20.08.2019 07:00

Mathematics, 20.08.2019 07:00