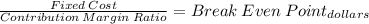

Piedmont company segments its business into two regions—north and south. the company prepared the contribution format segmented income statement as shown: total company north south sales $ 600,000 $ 400,000 $ 200,000 variable expenses 360,000 280,000 80,000 contribution margin 240,000 120,000 120,000 traceable fixed expenses 120,000 60,000 60,000 segment margin 120,000 $ 60,000 $ 60,000 common fixed expenses 50,000 net operating income $ 70,000 required: 1. compute the companywide break-even point in dollar sales. 2. compute the break-even point in dollar sales for the north region. 3. compute the break-even point in dollar sales for the south region.

Answers: 1

Another question on Business

Business, 22.06.2019 11:00

You are attending college in the fall and you need to purchase a computer. you must finance the purchase because your parents will not purchase it for you, and you do not have the cash on hand to purchase it. in blank #1 determine which type of credit would you use to finance your purchase (installment, non-installment, or revolving credit). (2 points) in blank #2 defend your credit choice by explaining why your financing option is the best option for you. (2 points) in blank #3 explain why you selected that credit option over the other two options available. (2 points)

Answers: 3

Business, 22.06.2019 12:50

Demand increases by less than supply increases. as a result, (a) equilibrium price will decline and equilibrium quantity will rise. (b) both equilibrium price and quantity will decline. (c) both equilibrium price and quantity will rise

Answers: 3

Business, 22.06.2019 19:30

Fly-by products, inc. operates primarily in the united states and has several segments. for the following segment, determine whether it is a cost center, profit center, or investment center: international operations- acts as an independent segment responsible for all facets of the business outside of the united states. select one: a. cost center b. profit center c. investment center

Answers: 2

Business, 23.06.2019 00:10

Mno corporation uses a job-order costing system with a predetermined overhead rate based on direct labor-hours. the company based its predetermined overhead rate for the current year on the following data: total estimated direct labor-hours 50,000 total estimated fixed manufacturing overhead cost $ 285,000 estimated variable manufacturing overhead per direct labor-hour $ 3.80 recently, job p123 was completed with the following characteristics: total actual direct labor-hours 20 direct materials $ 710 direct labor cost $ 500 the amount of overhead applied to job p123 is closest to:

Answers: 2

You know the right answer?

Piedmont company segments its business into two regions—north and south. the company prepared the co...

Questions

Mathematics, 27.06.2019 05:10

History, 27.06.2019 05:10

Computers and Technology, 27.06.2019 05:10

Computers and Technology, 27.06.2019 05:10

Biology, 27.06.2019 05:10

Biology, 27.06.2019 05:10

Biology, 27.06.2019 05:10