Business, 20.08.2019 20:30 carterlapere

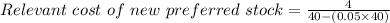

Tempo corp. will issue preferred stock to finance a new artillery line. the firm's existing preferred stock pays a dividend of $4.00 per share and is selling for $40 per share. investment bankers have advised tempo that flotation costs on the new preferred issue would be 5% of the selling price. tempo's marginal tax rate is 30%. what is the relevant cost of new preferred stock? a) 7.00%b) 7.37%c) 10.00%d) 10.53%e) 15.00%

Answers: 1

Another question on Business

Business, 21.06.2019 15:50

Aceramics manufacturer sold cups last year for $7.50 each. variable costs of manufacturing were $2.25 per unit. the company needed to sell 20,000 cups to break even. net income was $5,040. this year, the company expects the price per cup to be $9.00; variable manufacturing costs to increase 33.3%; and fixed costs to increase 10%. how many cups (rounded) does the company need to sell this year to break even?

Answers: 2

Business, 22.06.2019 07:30

Which two of the following are benefits of consumer programs

Answers: 1

Business, 22.06.2019 08:00

Interest is credited to a fixed annuity no lower than the variable contract rate contract guaranteed rate current rate of inflation prime rate

Answers: 2

Business, 22.06.2019 19:00

Question 55 ted, a supervisor for jack's pool supplies, was accused of stealing pool supplies and selling them to friends and relatives at reduced prices. given ted's earlier track record, he was not fired immediately. the authorities decided to give him an administrative leave, without pay, until the investigation was complete. in view of the given information, it would be most appropriate to say that ted was: demoted. discharged. suspended. dismissed.

Answers: 2

You know the right answer?

Tempo corp. will issue preferred stock to finance a new artillery line. the firm's existing preferre...

Questions

Business, 21.07.2019 14:10

Chemistry, 21.07.2019 14:10

Spanish, 21.07.2019 14:10

Spanish, 21.07.2019 14:10

Computers and Technology, 21.07.2019 14:10

Computers and Technology, 21.07.2019 14:10

Mathematics, 21.07.2019 14:10

Biology, 21.07.2019 14:10

Arts, 21.07.2019 14:10

Spanish, 21.07.2019 14:10

Mathematics, 21.07.2019 14:10

Mathematics, 21.07.2019 14:10