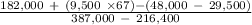

Russell's has annual revenue of $387,000 with costs of $216,400. depreciation is $48,900 and the tax rate is 30 percent. the firm has debt outstanding with a market value of $182,000 along with 9,500 shares of stock that is selling at $67 a share. the firm has $48,000 of cash of which $29,500 is needed to run the business. what is the firm's ev/ebitda ratio

Answers: 1

Another question on Business

Business, 22.06.2019 15:40

Acompany manufactures x units of product a and y units of product b, on two machines, i and ii. it has been determined that the company will realize a profit of $3 on each unit of product a and $4 on each unit of product b. to manufacture a unit of product a requires 7 min on machine i and 5 min on machine ii. to manufacture a unit of product b requires 8 min on mchine i and 5 min on machine ii. there are 175 min available on machine i and 125 min available on machine ii in each work shift. how many units of a product should be produced in each shift to maximize the company's profit p?

Answers: 2

Business, 22.06.2019 19:00

In 1975, mcdonald’s introduced its egg mcmuffin breakfast sandwich, which remains popular and profitable today. this longevity illustrates the idea of:

Answers: 1

Business, 22.06.2019 19:20

Although appealing to more refined tastes, art as a collectible has not always performed so profitably. during 2003, an auction house sold a sculpture at auction for a price of $10,211,500. unfortunately for the previous owner, he had purchased it in 2000 at a price of $12,177,500. what was his annual rate of return on this sculpture? (a negative answer should be indicated by a minus sign. do not round intermediate calculations and enter your answer as

Answers: 2

Business, 22.06.2019 22:50

What is one of the advantages of getting a government-sponsored mortgage instead of a conventional mortgage

Answers: 1

You know the right answer?

Russell's has annual revenue of $387,000 with costs of $216,400. depreciation is $48,900 and the tax...

Questions

Mathematics, 13.11.2020 21:50

Biology, 13.11.2020 21:50

Mathematics, 13.11.2020 21:50

English, 13.11.2020 21:50

Mathematics, 13.11.2020 21:50

Mathematics, 13.11.2020 21:50

English, 13.11.2020 21:50

Mathematics, 13.11.2020 21:50

Mathematics, 13.11.2020 21:50

Mathematics, 13.11.2020 21:50