Business, 26.08.2019 20:20 michaylabucknep7u3y2

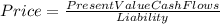

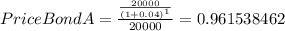

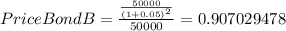

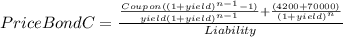

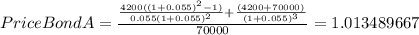

Company abc has liabilities of 20,000, 50,000 and 70,000 due at the end of years 1, 2 and 3 respectively. the company would like to exactly (absolutely) match these liabilities using the following assets: a one-year zero coupon bond with a yield of 4%a two-year zero coupon bond with a yield of 5%a three-year coupon bond with annual coupons of 6% and a yield of 5.5%what is the total cost of the asset portfolio that will exactly match the liabilities?

Answers: 1

Another question on Business

Business, 22.06.2019 01:30

If a firm plans to issue new stock, flotation costs (investment bankers' fees) should not be ignored. there are two approaches to use to account for flotation costs. the first approach is to add the sum of flotation costs for the debt, preferred, and common stock and add them to the initial investment cost. because the investment cost is increased, the project's expected return is reduced so it may not meet the firm's hurdle rate for acceptance of the project. the second approach involves adjusting the cost of common equity as follows: . the difference between the flotation-adjusted cost of equity and the cost of equity calculated without the flotation adjustment represents the flotation cost adjustment. quantitative problem: barton industries expects next year's annual dividend, d1, to be $1.90 and it expects dividends to grow at a constant rate g = 4.3%. the firm's current common stock price, p0, is $22.00. if it needs to issue new common stock, the firm will encounter a 6% flotation cost, f. assume that the cost of equity calculated without the flotation adjustment is 12% and the cost of old common equity is 11.5%. what is the flotation cost adjustment that must be added to its cost of retaine

Answers: 1

Business, 22.06.2019 12:50

There is a small, family-owned store that sells food and household goods in a small town. the owners have good relations with the community, especially with local farmers who supply much of the food. the farmers aren't organized into a cooperative or union, and the store deals with each individually. suppose the store wanted to buy some farms to control the supply of certain vegetables. how would you classify this strategic move? select one: a. horizontal integration b. forward integration c. backward integration d. concentric integration

Answers: 2

Business, 22.06.2019 20:00

Because this market is a monopolistically competitive market, you can tell that it is in long-run equilibrium by the fact thatmr=mc at the optimal quantity for each firm. furthermore, a monopolistically competitive firm's average total cost in long-run equilibrium isless than the minimum average total cost. true or false: this indicates that there is a markup on marginal cost in the market for engines. true false monopolistic competition may also be socially inefficient because there are too many or too few firms in the market. the presence of the externality implies that there is too little entry of new firms in the market.

Answers: 3

You know the right answer?

Company abc has liabilities of 20,000, 50,000 and 70,000 due at the end of years 1, 2 and 3 respecti...

Questions

Arts, 27.03.2021 06:40

Mathematics, 27.03.2021 06:40

English, 27.03.2021 06:40

English, 27.03.2021 06:40

Mathematics, 27.03.2021 06:40

Mathematics, 27.03.2021 06:40

Mathematics, 27.03.2021 06:40

English, 27.03.2021 06:40

Geography, 27.03.2021 06:40

Mathematics, 27.03.2021 06:40

Mathematics, 27.03.2021 06:40