Business, 27.08.2019 01:20 michaeldragon9663

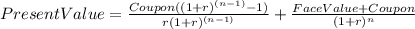

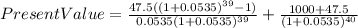

Assume that you are considering the purchase of a 20-year, noncallable bond with an annual coupon rate of 9.5%. the bond has a face value of $1,000, and it makes semiannual interest payments. if you require an 10.7% nominal yield to maturity on this investment, what is the maximum price you should be willing to pay for the bond?

Answers: 3

Another question on Business

Business, 22.06.2019 07:00

Imagine you own an established startup with growing profits. you are looking for funding to greatly expand company operations. what method of financing would be best for you?

Answers: 2

Business, 22.06.2019 10:30

Issued to the joint planning and execution community (jpec) initiates the development of coas; it also requests that the supported ccdr submit a commander's estimate of the situation with a recommended coa to resolve the situation (joint force command and staff participation in the joint operation planning and execution system, page 10)

Answers: 2

Business, 22.06.2019 12:50

Salaries are $4,500 per week for five working days and are paid weekly at the end of the day fridays. the end of the month falls on a thursday. the accountant for dayton company made the appropriate accrual adjustment and posted it to the ledger. the balance of salaries payable, as shown on the adjusted trial balance, will be a (assume that there was no beginning balance in the salaries payable account.)

Answers: 1

Business, 22.06.2019 17:40

Croy inc. has the following projected sales for the next five months: month sales in units april 3,850 may 3,875 june 4,260 july 4,135 august 3,590 croy’s finished goods inventory policy is to have 60 percent of the next month’s sales on hand at the end of each month. direct material costs $2.50 per pound, and each unit requires 2 pounds. raw materials inventory policy is to have 50 percent of the next month’s production needs on hand at the end of each month. raw materials on hand at march 31 totaled 3,741 pounds. 1. determine budgeted production for april, may, and june. 2. determine the budgeted cost of materials purchased for april, may, and june. (round your answers to 2 decimal places.)

Answers: 3

You know the right answer?

Assume that you are considering the purchase of a 20-year, noncallable bond with an annual coupon ra...

Questions

Mathematics, 11.05.2021 14:40

Mathematics, 11.05.2021 14:40

Mathematics, 11.05.2021 14:40

Social Studies, 11.05.2021 14:40

English, 11.05.2021 14:40

Social Studies, 11.05.2021 14:40

Biology, 11.05.2021 14:40

Mathematics, 11.05.2021 14:40

Chemistry, 11.05.2021 14:40

Mathematics, 11.05.2021 14:40

Mathematics, 11.05.2021 14:40

Mathematics, 11.05.2021 14:40