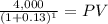

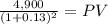

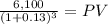

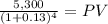

An investment project has annual cash inflows of $4,000, $4,900, $6,100, and $5,300, for the next four years, respectively. the discount rate is 13 percent. what is the discounted payback period for these cash flows if the initial cost is $6,700? what is the discounted payback period for these cash flows if the initial cost is $8,800? what is the discounted payback period for these cash flows if the initial cost is $11,800?

Answers: 3

Another question on Business

Business, 22.06.2019 07:50

Budget in this final week, you will develop a proposed budget of $150,000 for the first year of the program and complete the final concept paper for the proposed program due for senior management review. the budget should identify the program's anticipated expenses for the year ahead. budget line items should be consistent with the proposed program and staffing plan. using the readings for the week, the south university online library, and the internet, complete the following tasks: create a proposed budget of $150,000 for the first year of the proposed program including the cost for personnel, supplies, education materials, marketing costs, and so on in a microsoft excel spreadsheet. you may transfer your budget to your report. justify the cost for each item of the proposed budget in a budget narrative.

Answers: 2

Business, 22.06.2019 09:30

Oliver's company is planning the launch of their hybrid cars. the company has included "never-before-seen" product benefits in the hybrid cars. which type of advertising should oliver's company use for the new cars?

Answers: 1

Business, 22.06.2019 14:20

Anew 2-lane road is needed in a part of town that is growing. at some point the road will need 4 lanes to handle the anticipated traffic. if the city's optimistic estimate of growth is used, the expansion will be needed in 4 years and has a probability of happening of 40%. for the most likely and pessimistic estimates, the expansion will be needed in 8 and 15 years respectively. the probability of the pessimistic estimate happening is 20%. the expansion will cost $ 4.2 million and the interest rate is 8%. what is the expected pw the expansion will cost?

Answers: 1

Business, 22.06.2019 16:50

In terms of the "great wheel of science", statistics are central to the research process (a) only between the hypothesis phase and the observation phase (b) only between the observation phase and the empirical generalization phase (c) only between the theory phase and the hypothesis phase (d) only between the empirical generalization phase and the theory phase

Answers: 1

You know the right answer?

An investment project has annual cash inflows of $4,000, $4,900, $6,100, and $5,300, for the next fo...

Questions

Mathematics, 16.09.2020 23:01

Mathematics, 16.09.2020 23:01

English, 16.09.2020 23:01

Social Studies, 16.09.2020 23:01

Mathematics, 16.09.2020 23:01

Mathematics, 16.09.2020 23:01

Physics, 16.09.2020 23:01

Mathematics, 16.09.2020 23:01

Mathematics, 16.09.2020 23:01

English, 16.09.2020 23:01

Mathematics, 16.09.2020 23:01

Mathematics, 16.09.2020 23:01

Mathematics, 16.09.2020 23:01

Physics, 16.09.2020 23:01

Mathematics, 16.09.2020 23:01

Mathematics, 17.09.2020 01:01

Spanish, 17.09.2020 01:01

Mathematics, 17.09.2020 01:01

Mathematics, 17.09.2020 01:01

Mathematics, 17.09.2020 01:01