Business, 27.08.2019 03:10 DakotaOliver

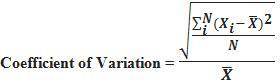

Mr. sam golff desires to invest a portion of his assets in rental property. he has narrowed his choices down to two apartment complexes, palmer heights and crenshaw village. after conferring with the present owners, mr. golff has developed the following estimates of the cash flows for these properties. palmer heights crenshaw village yearly aftertax yearly aftertaxcash inflow cash inflow(in thousands) probability (in thousands) probability$70 0.2 $75 0.2$75 0.2 $80 0.3$90 0.2 $90 0.4$105 0.2 $100 0.1$110 0.2a. find the expected cash flow from each apartment complex. b. what is the coefficient of variation for each apartment complex? c. which apartment complex has more risk?

Answers: 1

Another question on Business

Business, 22.06.2019 14:30

Amethod of allocating merchandise cost that assumes the first merchandise bought was the first merchandise sold is called the a. last-in, first-out method. b. first-in, first-out method. c. specific identification method. d. average cost method.

Answers: 3

Business, 22.06.2019 16:20

Stosch company's balance sheet reported assets of $112,000, liabilities of $29,000 and common stock of $26,000 as of december 31, year 1. if retained earnings on the balance sheet as of december 31, year 2, amount to $74,000 and stosch paid a $28,000 dividend during year 2, then the amount of net income for year 2 was which of the following? a)$23,000 b) $35,000 c) $12,000 d)$42,000

Answers: 1

Business, 22.06.2019 18:00

Large public water and sewer companies often become monopolies because they benefit from although the company faces high start-up costs, the firm experiences average production costs as it expands and adds more customers. smaller competitors would experience average costs and would be less

Answers: 1

Business, 22.06.2019 19:50

The common stock and debt of northern sludge are valued at $65 million and $35 million, respectively. investors currently require a return of 15.9% on the common stock and a return of 7.8% on the debt. if northern sludge issues an additional $14 million of common stock and uses this money to retire debt, what happens to the expected return on the stock? assume that the change in capital structure does not affect the interest rate on northern’s debt and that there are no taxes.

Answers: 2

You know the right answer?

Mr. sam golff desires to invest a portion of his assets in rental property. he has narrowed his choi...

Questions

Mathematics, 25.05.2021 18:20

Mathematics, 25.05.2021 18:20

English, 25.05.2021 18:20

Biology, 25.05.2021 18:20

Biology, 25.05.2021 18:20

Mathematics, 25.05.2021 18:20

Arts, 25.05.2021 18:20

Health, 25.05.2021 18:20