Business, 27.08.2019 20:00 loveoneonly4379

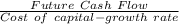

Suppose boyson corporation's projected free cash flow for next year is fcf1 = $100,000, and fcf is expected to grow at a constant rate of 6.5%. if the company's weighted average cost of capital is 11.5%, what is the firm's total corporate value?

Answers: 2

Another question on Business

Business, 21.06.2019 15:50

Which one of the following is never part of recording the requisition and issuance of raw materials in a job order cost system? debit finished goods inventory debit manufacturing overhead credit raw materials inventory debit work in process

Answers: 2

Business, 22.06.2019 10:10

Karen is working on classifying all her company’s products in terms of whether they have strong or weak market share and whether this share is in a slow or growing market. what type of strategic framework is she using?

Answers: 2

Business, 22.06.2019 17:00

During which of the following phases of the business cycle does the real gdp fall? a. trough b. expansion c. contraction d. peak

Answers: 2

Business, 22.06.2019 20:10

With signals from no-claim bonuses and deductibles, a. the marginal cost curve for careful drivers lies to the left of the marginal cost curve for aggressive drivers b. auto insurance companies insure more aggressive drivers than careful drivers because aggressive drivers have a greater need for the insurance c. the market for car insurance has a separating equilibrium, and the market is efficient d. most drivers pay higher premiums than if the market had no signals

Answers: 1

You know the right answer?

Suppose boyson corporation's projected free cash flow for next year is fcf1 = $100,000, and fcf is e...

Questions

Chemistry, 28.01.2020 20:43

Mathematics, 28.01.2020 20:43

History, 28.01.2020 20:43

Computers and Technology, 28.01.2020 20:43

Mathematics, 28.01.2020 20:43

Computers and Technology, 28.01.2020 20:43

Mathematics, 28.01.2020 20:43