Business, 28.08.2019 02:30 triggernugget05

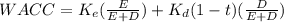

Afirm has a total value of $548,000 and debt valued at $262,000. what is the weighted average cost of capital if the aftertax cost of debt is 7.2 percent and the cost of equity is 12.6 percent?

Answers: 2

Another question on Business

Business, 20.06.2019 18:04

Before you begin to compose a message, you should conduct research to collect the necessary information. to avoid frustration and inaccurate messages, be sure to consider the receiver's position. which questions should you ask yourself before determining what and how to research?

Answers: 3

Business, 22.06.2019 08:10

Bakery has bought 250 pounds of muffin dough. they want to make waffles or muffins in half-dozen packs out of it. half a dozen of muffins requires 1 lb of dough and a pack of waffles uses 3/4 lb of dough. it take bakers 6 minutes to make a half-dozen of waffles and 3 minutes to make a half-dozen of muffins. their profit will be $1.50 on each pack of waffles and $2.00 on each pack of muffins. how many of each should they make to maximize profit, if they have just 20 hours to do everything?

Answers: 3

Business, 22.06.2019 12:50

In june 2009, at the trough of the great recession, the bureau of labor statistics announced that of all adult americans, 140,196,000 were employed, 14,729,000 were unemployed and 80,729,000 were not in the labor force. use this information to calculate: a. the adult population b. the labor force c. the labor-force participation rate d. the unemployment rate

Answers: 3

Business, 22.06.2019 15:20

Martinez company has the following two temporary differences between its income tax expense and income taxes payable. 2017 2018 2019 pretax financial income $873,000 $866,000 $947,000 (2017' 2018, 2019) excess depreciation expense on tax return (29,400 ) (39,000 ) (9,600 ) (2017' 2018, 2019) excess warranty expense in financial income 20,000 9,900 8,300 (2017' 2018, 2019) taxable income $863,600 $836,900 $945,700(2017' 2018, 2019) the income tax rate for all years is 40%. instructions: a. prepare the journal entry to record income tax expense, deferred income taxes, and income taxes payable for 2017, 2018, and 2019. b. assuming there were no temporary differences prior to 2016, indicate how deferred taxes will be reported on the 2016 balance sheet. button's warranty is for 12 months. c. prepare the income tax expense section of the income statement for 2017, beginning with the line, "pretax financial income."

Answers: 3

You know the right answer?

Afirm has a total value of $548,000 and debt valued at $262,000. what is the weighted average cost o...

Questions

English, 13.09.2020 09:01

Physics, 13.09.2020 09:01

Spanish, 13.09.2020 09:01

Mathematics, 13.09.2020 09:01

Chemistry, 13.09.2020 09:01

Mathematics, 13.09.2020 09:01

History, 13.09.2020 09:01

History, 13.09.2020 09:01

Mathematics, 13.09.2020 09:01

Mathematics, 13.09.2020 09:01

Mathematics, 13.09.2020 09:01

Mathematics, 13.09.2020 09:01

Mathematics, 13.09.2020 09:01

Mathematics, 13.09.2020 09:01

English, 13.09.2020 09:01

Arts, 13.09.2020 09:01

Mathematics, 13.09.2020 09:01

Mathematics, 13.09.2020 09:01

Mathematics, 13.09.2020 09:01

English, 13.09.2020 09:01