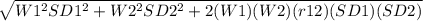

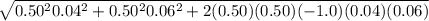

Consider the following data on returns (r), standard deviation weights (w), and correlations (r) for two stocks: r1 = 10%, ? 1 = 4%, r2 = 20%, ? 2 = 6%, r12 = -1.0, w1=0.50, w2=0.50what is the standard deviation of a portfolio of stocks 1 and 2 with the above weights? 1. 1.0%2. 1.10%3. 10%4. none of the given answers is correct.5. 0.20%

Answers: 1

Another question on Business

Business, 21.06.2019 18:30

What is the communication process? why isnt it possible to communicate without using all the elements in the communication process?

Answers: 3

Business, 22.06.2019 09:30

Factors like the unemployment rate, the stock market, global trade, economic policy, and the economic situation of other countries have no influence on the financial status of individuals. question 1 options: true false

Answers: 1

Business, 22.06.2019 12:00

Need today! will get brainliest for right answer! compare and contrast absolute advantage and comparative advantage.

Answers: 1

Business, 22.06.2019 12:40

Kumar consulting operates several stock investment portfolios that are used by firms for investment of pension plan assets. last year, one portfolio had a realized return of 12.6 percent and a beta coefficient of 1.15. the average t-bond rate was 7 percent and the realized rate of return on the s& p 500 was 12 percent. what was the portfolio's alpha?

Answers: 1

You know the right answer?

Consider the following data on returns (r), standard deviation weights (w), and correlations (r) fo...

Questions

Mathematics, 22.03.2021 20:00

History, 22.03.2021 20:00

Mathematics, 22.03.2021 20:00

Mathematics, 22.03.2021 20:00

History, 22.03.2021 20:00

Mathematics, 22.03.2021 20:00