Business, 05.09.2019 16:10 TatlTael7321

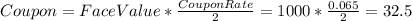

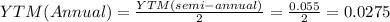

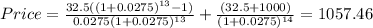

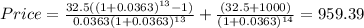

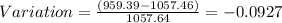

The corner grocer has a 7-year, 6.5 percent semiannual coupon bond outstanding with a $1,000 par value. the bond has a yield to maturity of 5.5 percent. which one of the following statements is correct if the market yield suddenly increases to 7.25 percent? a) the bond price will decrease by 9.27 percent. b) the bond price will increase by 3.86 percent. c) the bond price will decrease by 8.64 percent. d) the bond price will increase by 7.16 percent. e) the bond price will increase by 7.04 percent

Answers: 3

Another question on Business

Business, 21.06.2019 20:30

Which of the following best describes how the federal reserve bank banks during a bank run? a. the federal reserve bank has the power to take over a private bank if customers demand too many withdrawals. b. the federal reserve bank can provide a short-term loan to banks to prevent them from running out of money. c. the federal reserve bank regulates exchanges to prevent the demand for withdrawals from rising above the required reserve ratio. d. the federal reserve bank acts as an insurance company that pays customers if their bank fails. 2b2t

Answers: 3

Business, 22.06.2019 14:00

How many months does the federal budget usually take to prepare

Answers: 1

Business, 22.06.2019 23:30

What is the difference between career options in the law enforcement pathway and career options in the correction services pathway?

Answers: 1

Business, 23.06.2019 09:00

The average cost of one year at a private college in 2012-2013 is $43,289. the average grant aid received by a student at a private college in 2012-2013 is $15,680.what is the average student contribution for one year at a private college in 2012-2013?

Answers: 2

You know the right answer?

The corner grocer has a 7-year, 6.5 percent semiannual coupon bond outstanding with a $1,000 par val...

Questions

Geography, 25.06.2019 09:30

Mathematics, 25.06.2019 09:30

SAT, 25.06.2019 09:30

History, 25.06.2019 09:30

Social Studies, 25.06.2019 09:30