Answers: 1

Another question on Business

Business, 21.06.2019 18:20

Uppose the book-printing industry is competitive and begins in a long-run equilibrium. then hi-tech printing company invents a new process that sharply reduces the cost of printing books. suppose hi-tech's patent prevents other firms from using the new technology. which of the following statements are true about what happens in the short run? check all that apply. hi-tech's average-total-cost curve shifts downward. hi-tech's profits increase. the price of books remains the same. hi-tech's marginal-cost curve remains the same.

Answers: 1

Business, 22.06.2019 13:00

Creation landscaping has 1,000 bonds outstanding that are selling for $1,280 each. the company also has 2,000 shares of preferred stock outstanding, currently priced at $27.20 a share. the common stock is priced at $37.00 a share and there are 28,000 shares outstanding. what is the weight of the debt as it relates to the firm's weighted average cost of capital?

Answers: 1

Business, 22.06.2019 17:50

What additional information about the numbers used to compute this ratio might be useful in you assess liquidity? (select all that apply) (a) the maturity schedule of current liabilities (b) the average stock price for the industry (c) the average current ratio for the industry (d) the amount of current assets that is concentrated in relatively illiquid inventories

Answers: 3

Business, 22.06.2019 20:10

Russell's is considering purchasing $697,400 of equipment for a four-year project. the equipment falls in the five-year macrs class with annual percentages of .2, .32, .192, .1152, .1152, and .0576 for years 1 to 6, respectively. at the end of the project the equipment can be sold for an estimated $135,000. the required return is 13.2 percent and the tax rate is 23 percent. what is the amount of the aftertax salvage value of the equipment assuming no bonus depreciation is taken

Answers: 2

You know the right answer?

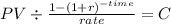

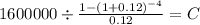

Investment a requires a net investment of $1,600,000. the required rate of return is 12% for the fou...

Questions

Mathematics, 10.09.2019 00:30

Mathematics, 10.09.2019 00:30

Computers and Technology, 10.09.2019 00:30

Mathematics, 10.09.2019 00:30

Mathematics, 10.09.2019 00:30