Business, 05.09.2019 20:10 tlturner03

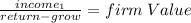

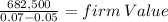

Afirm's current profits are $650,000. these profits are expected to grow indefinitely at a constant annual rate of 5 percent. if the firm's opportunity cost of funds is 7 percent, determine the value of the firm: round your responses to 2 decimal places. a. the instant before it pays out current profits as dividendsb. the instant after it pays out current profits as dividends.

Answers: 1

Another question on Business

Business, 22.06.2019 04:30

4. the condition requires that only one of the selected criteria be true for a record to be displayed.

Answers: 1

Business, 22.06.2019 16:00

If the family’s net monthly income is 7,800 what percent of the income is spent on food clothing and housing?

Answers: 3

Business, 23.06.2019 21:00

Acompany recently announced that it would be going public. the usual suspects, morgan stanley, jpmorgan chase, and goldman sachs will be the lead underwriters. the value of the company has been estimated to range from a low of $5billion to a high of $100billion, with $45billion being the most likely value. if there is a 20% chance that the price will be at the low end, a 10% chance that the price will be at the high end, and a 70% chance that the price will be in the middle, what value should the owner expect the company to price at?

Answers: 3

Business, 24.06.2019 03:30

What is the opportunity cost (in civilian output) of a defense buildup that raises military spending from 4.4 to 4.9 percent of a $7 trillion economy?

Answers: 1

You know the right answer?

Afirm's current profits are $650,000. these profits are expected to grow indefinitely at a constant...

Questions

Mathematics, 11.01.2020 21:31

Mathematics, 11.01.2020 21:31

Biology, 11.01.2020 21:31

Computers and Technology, 11.01.2020 21:31

Social Studies, 11.01.2020 21:31

Mathematics, 11.01.2020 21:31

History, 11.01.2020 21:31

Mathematics, 11.01.2020 21:31

English, 11.01.2020 21:31

Mathematics, 11.01.2020 21:31

English, 11.01.2020 21:31