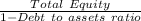

Stewart inc.'s latest eps was $3.50, its book value per share was $22.75, it had 220,000 shares outstanding, and its debt-to-assets ratio was 46%. how much debt was outstanding? select the correct answer. a. $4,262,849 b. $4,264,188 c. $4,263,519 d. $4,263,184 e. $4,263,853

Answers: 3

Another question on Business

Business, 21.06.2019 14:30

Assuming no direct factory overhead costs (i.e., inventory carry costs) and $3 million dollars in combined promotion and sales budget, the deft product manager wishes to achieve a product contribution margin of 35%. given their product currently is priced at $35.00, what would they need to limit the material and labor costs to?

Answers: 3

Business, 21.06.2019 23:30

The uno company was formed on january 2, year 1, to sell a single product. over a 2-year period, uno’s acquisition costs have increased steadily. physical quantities held in inventory were equal to 3 months’ sales at december 31, year 1, and zero at december 31, year 2. assuming the periodic inventory system, the inventory cost method which reports the highest amount for each of the following is inventory december 31, year 1/ cost of sales year 2 a: lifo fifo b: lifo lifo c: fifo fifo d: fifo lifo

Answers: 3

Business, 22.06.2019 00:20

Suppose an economy consists of three sectors: energy (e), manufacturing (m), and agriculture (a). sector e sells 70% of its output to m and 30% to a. sector m sells 30% of its output to e, 50% to a, and retains the rest. sector a sells 15% of its output to e, 30% to m, and retains the rest.

Answers: 1

Business, 22.06.2019 12:10

Bonds often pay a coupon twice a year. for the valuation of bonds that make semiannual payments, the number of periods doubles, whereas the amount of cash flow decreases by half. using the values of cash flows and number of periods, the valuation model is adjusted accordingly. assume that a $1,000,000 par value, semiannual coupon us treasury note with three years to maturity has a coupon rate of 3%. the yield to maturity (ytm) of the bond is 7.70%. using this information and ignoring the other costs involved, calculate the value of the treasury note:

Answers: 1

You know the right answer?

Stewart inc.'s latest eps was $3.50, its book value per share was $22.75, it had 220,000 shares outs...

Questions

Mathematics, 04.11.2020 01:50

English, 04.11.2020 01:50

Mathematics, 04.11.2020 01:50

Business, 04.11.2020 01:50

Mathematics, 04.11.2020 01:50

Mathematics, 04.11.2020 01:50

Mathematics, 04.11.2020 01:50

History, 04.11.2020 01:50

Mathematics, 04.11.2020 01:50

Mathematics, 04.11.2020 01:50

Biology, 04.11.2020 01:50

Mathematics, 04.11.2020 01:50