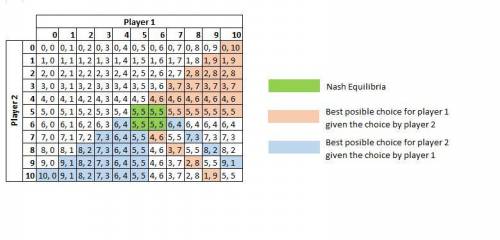

Two people have $10 to divide between themselves. they use the following procedure to divide the money. each person names a nonnegative integer between 0 and 10. if the sum of the amounts that the people name is at most 10 then each person receives the amount of money he names (and the remainder is destroyed). if the sum amounts of the people name exceeds 10 and the amounts named are different, then the person who names the smaller amount receives that amount and the other person receives the remaining money. if the sum of the amounts the people name exceeds 10 and the amounts named are the same then each person receives $5. formulate this situation as a strategic game and find all pure nash equilibria. (hint: you need to write down the matrix of payoffs.)

Answers: 2

Another question on Business

Business, 21.06.2019 23:50

Juan has a retail business selling skateboard supplies he maintains large stockpiles of every item he sells in a warehouse on the outskirts of town he keeps finding that he has to reorder certain supplies all the time but others only once a year how can he solve this problem?

Answers: 1

Business, 22.06.2019 11:00

Which ranks these careers that employers are most likely to hire from the least to the greatest?

Answers: 2

Business, 22.06.2019 15:00

Magic realm, inc., has developed a new fantasy board game. the company sold 15,000 games last year at a selling price of $20 per game. fixed expenses associated with the game total $182,000 per year, and variable expenses are $6 per game. production of the game is entrusted to a printing contractor. variable expenses consist mostly of payments to this contractor.required: 1-a. prepare a contribution format income statement for the game last year.1-b. compute the degree of operating leverage.2. management is confident that the company can sell 58,880 games next year (an increase of 12,880 games, or 28%, over last year). given this assumption: a. what is the expected percentage increase in net operating income for next year? b. what is the expected amount of net operating income for next year? (do not prepare an income statement; use the degree of operating leverage to compute your answer.)

Answers: 2

Business, 22.06.2019 15:30

Calculate the required rate of return for climax inc., assuming that (1) investors expect a 4.0% rate of inflation in the future, (2) the real risk-free rate is 3.0%, (3) the market risk premium is 5.0%, (4) the firm has a beta of 2.30, and (5) its realized rate of return has averaged 15.0% over the last 5 years. do not round your intermediate calculations.

Answers: 3

You know the right answer?

Two people have $10 to divide between themselves. they use the following procedure to divide the mon...

Questions

Mathematics, 19.12.2021 05:00

English, 19.12.2021 05:10

Mathematics, 19.12.2021 05:10

Mathematics, 19.12.2021 05:10

Biology, 19.12.2021 05:10

Mathematics, 19.12.2021 05:10

Physics, 19.12.2021 05:10

English, 19.12.2021 05:10