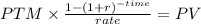

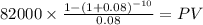

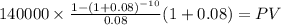

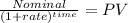

Harding company is in the process of purchasing several large pieces of equipment from danning machine corporation. several financing alternatives have been offered by danning: ((fv of $1, pv of $1, fva of $1, pva of $1, fvad of $1 and pvad of $1) (use appropriate factor(s) from the tables provided.) 1. pay $1,080,000 in cash immediately. 2.pay $400,000 immediately and the remainder in 10 annual installments of $82,000, with the first installment due in one year. 3. make 10 annual installments of $140,000 with the first payment due immediately. 4. make one lump-sum payment of $1,610,000 five years from date of purchase. required: determine the best alternative for harding, assuming that harding can borrow funds at a 8% interest rate. (round your final answers to nearest whole dollar amount.)

Answers: 1

Another question on Business

Business, 21.06.2019 22:10

You have just received notification that you have won the $2.0 million first prize in the centennial lottery. however, the prize will be awarded on your 100th birthday (assuming you're around to collect), 66 years from now. what is the present value of your windfall if the appropriate discount rate is 8 percent?

Answers: 1

Business, 22.06.2019 07:10

9. tax types: taxes are classified based on whether they are applied directly to income, called direct taxes, or to some other measurable performance characteristic of the firm, called indirect taxes. identify each of the following as a “direct tax,” an “indirect tax,” or something else: a. corporate income tax paid by a japanese subsidiary on its operating income b. royalties paid to saudi arabia for oil extracted and shipped to world markets c. interest received by a u.s. parent on bank deposits held in london d. interest received by a u.s. parent on a loan to a subsidiary in mexico e. principal repayment received by u.s. parent from belgium on a loan to a wholly owned subsidiary in belgium f. excise tax paid on cigarettes manufactured and sold within the united states g. property taxes paid on the corporate headquarters building in seattle h. a direct contribution to the international committee of the red cross for refugee relief i. deferred income tax, shown as a deduction on the u.s. parent’s consolidated income tax j. withholding taxes withheld by germany on dividends paid to a united kingdom parent corporation

Answers: 2

Business, 22.06.2019 07:30

Which of the following is an example of an unsought good? a. cameron purchases a new bike. b. jordan buys paper towels. c. taylor buys cupcakes from her favorite bakery. d. riley buys new windshield wipers for her car.

Answers: 3

Business, 22.06.2019 11:00

When the federal reserve buys bonds from or sells bonds to member banks, it is called monetary policy reserve ratio interest rate adjustment open market operations

Answers: 1

You know the right answer?

Harding company is in the process of purchasing several large pieces of equipment from danning machi...

Questions

Mathematics, 21.09.2019 20:50

Mathematics, 21.09.2019 20:50

Biology, 21.09.2019 20:50

Mathematics, 21.09.2019 20:50

Biology, 21.09.2019 20:50

Biology, 21.09.2019 20:50

Mathematics, 21.09.2019 20:50

Mathematics, 21.09.2019 20:50

Biology, 21.09.2019 20:50