Business, 10.09.2019 02:30 deannajd03

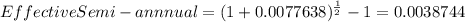

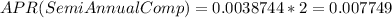

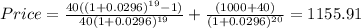

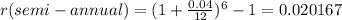

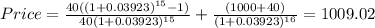

You buy a ten-year bond with an 8% coupon rate at a yield-to-maturity of 6%. (both rates follow the bey convention.) you hold the bond for two years, reinvesting coupons in a money market account earning an apr of 4%, compounded monthly. on the day you receive the fourth coupon, you sell the bond. since market interest rates have increased, you sell it at a yield-to-maturity of 8%. what is your realized compound yield? report the realized compound yield as an apr with semi-annual compounding.

Answers: 1

Another question on Business

Business, 22.06.2019 12:10

Drag each label to the correct location on the image determine which actions by a manager are critical interactions - listening to complaints - interacting with customers - responding to complaints - assigning staff duties -taking action to address customer grievances -keeping track of reservations

Answers: 2

Business, 23.06.2019 19:00

The unadjusted trial balance of the manufacturing equitable at december 31, 2018, the end of its fiscal year, included the following account balances. manufacturing’s 2018 financial statements were issued on april 1, 2019. accounts receivable $ 114,250 accounts payable 53,600 bank notes payable 670,000 mortgage note payable 1,270,000 other information: the bank notes, issued august 1, 2018, are due on july 31, 2019, and pay interest at a rate of 12%, payable at maturity. the mortgage note is due on march 1, 2019. interest at 11% has been paid up to december 31 (assume 11% is a realistic rate). manufacturing intended at december 31, 2018, to refinance the note on its due date with a new 10-year mortgage note. in fact, on march 1, manufacturing paid $263,000 in cash on the principal balance and refinanced the remaining $1,007,000. included in the accounts receivable balance at december 31, 2018, were two subsidiary accounts that had been overpaid and had credit balances totaling $19,650. the accounts were of two major customers who were expected to order more merchandise from manufacturing and apply the overpayments to those future purchases. on november 1, 2018, manufacturing rented a portion of its factory to a tenant for $32,400 per year, payable in advance. the payment for the 12 months ended october 31, 2019, was received as required and was credited to rent revenue. required: (1) prepare any necessary adjusting journal entries at december 31, 2018, pertaining to each item of other information (2) prepare the current and long-term liability sections of the december 31, 2018, balance sheet. balance sheet (partial) at december 31, 2018 current liabilities: total current liabilities long-term liabilities:

Answers: 1

Business, 23.06.2019 20:00

Abrief overview of your company's strengths, weaknesses, opportunities, and threats is called a branding strategy. financial evaluation. paranoid scenario. situational analysis.

Answers: 1

Business, 23.06.2019 23:50

Which of the following statements best describes the results provided by market research? a. market research allows producers to create trends that lead to more sales. b. market research lets producers predict what laws the government is planning to make. c. market research tells producers what consumers want and what they're willing to pay. d. market research producers understand market forces better.

Answers: 2

You know the right answer?

You buy a ten-year bond with an 8% coupon rate at a yield-to-maturity of 6%. (both rates follow the...

Questions

Mathematics, 07.04.2020 23:37

History, 07.04.2020 23:37

Mathematics, 07.04.2020 23:37

Mathematics, 07.04.2020 23:37

English, 07.04.2020 23:37

Mathematics, 07.04.2020 23:37

Mathematics, 07.04.2020 23:37

Biology, 07.04.2020 23:37

}

}

}

}

![\sqrt[2]{\frac{FV}{PV} }-1=r](/tpl/images/0226/3996/3e6ed.png)

![\sqrt[2]{\frac{(1009.02+164.91}{1155.91} }-1=r =0.0077638](/tpl/images/0226/3996/38494.png)