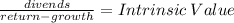

Boehm incorporated is expected to pay a $2.20 per share dividend at the end of this year (i. e., d1 = $2.20). the dividend is expected to grow at a constant rate of 3% a year. the required rate of return on the stock, rs, is 13%. what is the estimated value per share of boehm's stock? do not round intermediate calculations. round your answer to the nearest cent.

Answers: 3

Another question on Business

Business, 21.06.2019 15:10

In which of the following situations would the price of a good be most likely to increase? a. a breakthrough in productive technology enables a company to increase its output. b. an increase in production costs results from a rise in wages. c. there's a sudden increase in the number of companies competing to sell the good. d. a drop in demand happens too quickly for producers to decrease production to keep up.

Answers: 1

Business, 22.06.2019 08:00

How do communism and socialism differ in terms of the role that government plays in the economy ?

Answers: 1

Business, 22.06.2019 18:50

Plastic and steel are substitutes in the production of body panels for certain automobiles. if the price of plastic increases, with other things remaining the same, we would expect: a) the demand curve for plastic to shift to the left. b) the price of steel to fall. c) the demand curve for steel to shift to the left d) nothing to happen to steel because it is only a substitute for plastic. e) the demand curve for steel to shift to the right

Answers: 3

You know the right answer?

Boehm incorporated is expected to pay a $2.20 per share dividend at the end of this year (i. e., d1...

Questions

Mathematics, 07.06.2021 21:10

Mathematics, 07.06.2021 21:10

Mathematics, 07.06.2021 21:10

Mathematics, 07.06.2021 21:10

Mathematics, 07.06.2021 21:10

Biology, 07.06.2021 21:10

Mathematics, 07.06.2021 21:10

Mathematics, 07.06.2021 21:10

Mathematics, 07.06.2021 21:10

English, 07.06.2021 21:10