Business, 10.09.2019 21:30 ltorline123

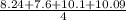

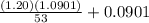

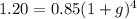

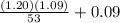

Suppose powers ltd., just issued a dividend of $1.20 per share on it common stock. the company paid dividends of $.85, $.92, $.99, and $1.09 per share in the last four years. if the stock currently sells for $53, what is your best estimate of the company's cost of equity capital using arithmetic and geometric growth rates?

Answers: 3

Another question on Business

Business, 22.06.2019 12:00

In the united states, one worker can produce 10 tons of steel per day or 20 tons of chemicals per day. in the united kingdom, one worker can produce 5 tons of steel per day or 15 tons of chemicals per day. the united kingdom has a comparative advantage in the production of:

Answers: 2

Business, 22.06.2019 12:50

There is a small, family-owned store that sells food and household goods in a small town. the owners have good relations with the community, especially with local farmers who supply much of the food. the farmers aren't organized into a cooperative or union, and the store deals with each individually. suppose the store wanted to buy some farms to control the supply of certain vegetables. how would you classify this strategic move? select one: a. horizontal integration b. forward integration c. backward integration d. concentric integration

Answers: 2

Business, 23.06.2019 20:30

If something happens to alter the quantity supplied at any given price, then we move along the fixed supply curve to a new quantity supplied. a. true b. false

Answers: 1

You know the right answer?

Suppose powers ltd., just issued a dividend of $1.20 per share on it common stock. the company paid...

Questions

Advanced Placement (AP), 14.07.2019 15:00

History, 14.07.2019 15:00

Physics, 14.07.2019 15:00

Physics, 14.07.2019 15:00