Business, 11.09.2019 01:30 live4dramaoy0yf9

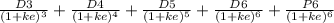

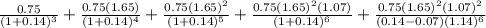

Simpkins corporation does not pay any dividends because it is expanding rapidly and needs to retain all of its earnings. however, investors expect simpkins to begin paying dividends, with the first dividend of $0.75 coming 3 years from today. the dividend should grow rapidly - at a rate of 65% per year - during years 4 and 5. after year 5, the company should grow at a constant rate of 7% per year. if the required return on the stock is 14%, what is the value of the stock today (assume the market is in equilibrium with the required return equal to the expected return)? do not round intermediate calculations. round your answer to the nearest cent.

Answers: 2

Another question on Business

Business, 22.06.2019 02:10

Materials purchases (on credit). direct materials used in production. direct labor paid and assigned to work in process inventory. indirect labor paid and assigned to factory overhead. overhead costs applied to work in process inventory. actual overhead costs incurred, including indirect materials. (factory rent and utilities are paid in cash.) transfer of jobs 306 and 307 to finished goods inventory. cost of goods sold for job 306. revenue from the sale of job 306. assignment of any underapplied or overapplied overhead to the cost of goods sold account. (the amount is not material.) 2. prepare journal entries for the month of april to record the above transactions.

Answers: 1

Business, 22.06.2019 21:00

Roberto and reagan are both 25 percent owner/managers for bright light inc. roberto runs the retail store in sacramento, ca, and reagan runs the retail store in san francisco, ca. bright light inc. generated a $125,000 profit companywide made up of a $75,000 profit from the sacramento store, a ($25,000) loss from the san francisco store, and a combined $75,000 profit from the remaining stores. if bright light inc. is an s corporation, how much income will be allocated to roberto?

Answers: 2

Business, 23.06.2019 01:10

Hillside issues $4,000,000 of 6%, 15-year bonds dated january 1, 2016, that pay interest semiannually on june 30 and december 31. the bonds are issued at a price of $4,895,980. required: 1. prepare the january 1, 2016, journal entry to record the bonds’ issuance

Answers: 3

Business, 23.06.2019 03:00

For example, the upper right cell shows that if expresso advertises and beantown doesn't advertise, expresso will make a profit of $15 million, and beantown will make a profit of $2 million. assume this is a simultaneous game and that expresso and beantown are both profit-maximizing firms. if expresso decides to advertise, it will earn a profit of $ million if beantown advertises and a profit of $ million if beantown does not advertise. if expresso decides not to advertise, it will earn a profit of $ million if beantown advertises and a profit of $ million if beantown does not advertise. if beantown advertises, expresso makes a higher profit if it chooses . if beantown doesn't advertise, expresso makes a higher profit if it chooses . suppose that both firms start off not advertising. if the firms act independently, what strategies will they end up choosing? expresso will choose to advertise and beantown will choose not to advertise. expresso will choose not to advertise and beantown will choose to advertise. both firms will choose to advertise. both firms will choose not to advertise.

Answers: 1

You know the right answer?

Simpkins corporation does not pay any dividends because it is expanding rapidly and needs to retain...

Questions

Mathematics, 25.06.2020 08:01

History, 25.06.2020 08:01

English, 25.06.2020 08:01

Mathematics, 25.06.2020 08:01

History, 25.06.2020 08:01

Mathematics, 25.06.2020 08:01

History, 25.06.2020 08:01

English, 25.06.2020 08:01

Biology, 25.06.2020 08:01

Mathematics, 25.06.2020 08:01

.

.

= 18.51

= 18.51