Business, 11.09.2019 02:20 nikeabrown01

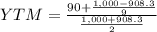

Hooper printing inc. has bonds outstanding with 9 years left to maturity. the bonds have a 8% annual coupon rate and were issued 1 year ago at their par value of $1,000. however, due to changes in interest rates, the bond's market price has fallen to $908.30. the capital gains yield last year was -9.17%. what is the yield to maturity?

Answers: 3

Another question on Business

Business, 22.06.2019 15:30

Calculate the required rate of return for climax inc., assuming that (1) investors expect a 4.0% rate of inflation in the future, (2) the real risk-free rate is 3.0%, (3) the market risk premium is 5.0%, (4) the firm has a beta of 2.30, and (5) its realized rate of return has averaged 15.0% over the last 5 years. do not round your intermediate calculations.

Answers: 3

Business, 22.06.2019 23:00

If the reserve requirement is 10 percent, what amount of excess reserves does a bank acquire when a business deposits a $500 check drawn on another bank?

Answers: 2

Business, 22.06.2019 23:30

An outside supplier has offered to sell talbot similar wheels for $1.25 per wheel. if the wheels are purchased from the outside supplier, $15,000 of annual fixed overhead could be avoided and the facilities now being used could be rented to another company for $45,000 per year. direct labor is a variable cost. if talbot chooses to buy the wheel from the outside supplier, then annual net operating income would:

Answers: 1

Business, 22.06.2019 23:30

Lucido products markets two computer games: claimjumper and makeover. a contribution format income statement for a recent month for the two games appears below: claimjumper makeover total sales $ 30,000 $ 70,000 $ 100,000 variable expenses 20,000 50,000 70,000 contribution margin $ 10,000 $ 20,000 30,000 fixed expenses 24,000 net operating income $ 6,000 required: 1. compute the overall contribution margin (cm) ratio for the company.. 2. compute the overall break-even point for the company in dollar sales. 3. complete the contribution format income statement at break-even point for the company showing the appropriate levels of sales for the two products. (do not round intermediate calculations.)

Answers: 1

You know the right answer?

Hooper printing inc. has bonds outstanding with 9 years left to maturity. the bonds have a 8% annual...

Questions

English, 19.11.2020 01:00

Mathematics, 19.11.2020 01:00

Mathematics, 19.11.2020 01:00

Mathematics, 19.11.2020 01:00

English, 19.11.2020 01:00

Mathematics, 19.11.2020 01:00

History, 19.11.2020 01:00

Chemistry, 19.11.2020 01:00

English, 19.11.2020 01:00

Health, 19.11.2020 01:00

Mathematics, 19.11.2020 01:00

Mathematics, 19.11.2020 01:00

Mathematics, 19.11.2020 01:00