Business, 13.09.2019 04:30 misrachel03

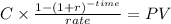

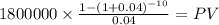

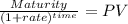

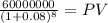

The longo corporation issued $60 million maturity value in notes, carrying a coupon rate of six percent, with interest paid semiannually. at the time of the note issue, equivalent risk-rated debt instruments carried yield rates of eight percent. the notes matured in five years. calculate the proceeds that longo corporation will receive from the sale of the notes. how will the notes be disclosed on longo’s balance sheet immediately following the sale? calculate the interest expense for longo corporation for the first year that the notes are outstanding. calculate the balance sheet value of the notes at the end of the first year

Answers: 1

Another question on Business

Business, 21.06.2019 20:40

Which of the following actions is most likely to result in a decrease in the money supply? a. the discount rate on overnight loans is lowered. b. the government sells a new batch of treasury bonds. c. the federal reserve bank buys treasury bonds. d. the required reserve ratio for banks is decreased. 2b2t

Answers: 2

Business, 22.06.2019 20:00

Suppose a country's productivity last year was 84. if this country's productivity growth rate of 5 percent is to be maintained, this means that this year's productivity will have to be:

Answers: 2

Business, 22.06.2019 20:00

Which motion below could be made so that the chair would be called on to enforce a violated rule?

Answers: 2

Business, 23.06.2019 02:20

When the benefit of one particular use of a resource is greater than the opportunity cost, then that resource is which of the following? a. not scarce b. being used efficiently c. a normal good d. non-excludable

Answers: 2

You know the right answer?

The longo corporation issued $60 million maturity value in notes, carrying a coupon rate of six perc...

Questions

Mathematics, 10.12.2019 21:31

Mathematics, 10.12.2019 21:31

English, 10.12.2019 21:31

Mathematics, 10.12.2019 21:31

Mathematics, 10.12.2019 21:31

Physics, 10.12.2019 21:31

English, 10.12.2019 21:31