Business, 17.09.2019 23:00 katiemh8302

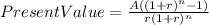

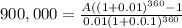

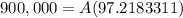

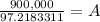

Mortgages, loans taken to purchase a property, involve regular payments at fixed intervals and are treated as reverse annuities. mortgages are the reverse of annuities, because you get a lump-sum amount as a loan in the beginning, and then you make monthly payments to the lender. you’ve decided to buy a house that is valued at $1 million. you have $100,000 to use as a down payment on the house, and want to take out a mortgage for the remainder of the purchase price. your bank has approved your $900,000 mortgage, and is offering a standard 30-year mortgage at a 12% fixed nominal interest rate (called the loan’s annual percentage rate or apr). under this loan proposal, your mortgage payment will be per month. (note: round the final value of any interest rate used to four decimal places.)

Answers: 2

Another question on Business

Business, 21.06.2019 20:40

Alocal club is selling christmas trees and deciding how many to stock for the month of december. if demand is normally distributed with a mean of 100 and standard deviation of 20, trees have no salvage value at the end of the month, trees cost $20, and trees sell for $50 what is the service level?

Answers: 2

Business, 22.06.2019 00:20

Suppose that the world price of steel is $100 a ton, india does not trade internationally, and the equilibrium price of steel in india is $60 a ton. suppose that india now begins to trade internationally. the price of steel in india the quantity of steel produced in india a. does not change; does not change b. falls; increases c. falls; decreases d. rises; decreases e. rises; increases the quantity of steel bought by india india steel. a. increases; exports b. decreases; imports c. decreases; exports d. does not change; neither imports nor exports e. increases; imports

Answers: 2

Business, 22.06.2019 03:30

Lo.2, 3, 9 lori, who is single, purchased 5-years class property for $200,00 and 7-years class property for $420,000 on may 20, 2018. lori experts the taxable income derived form the business (without regard to the amount expensed under ⧠179) to be about $550,000. lori has determined that she should elect immediate ⧠179 expensing in the amount of $520,000, but she doesn’t know which asset she should completely expense under ⧠179. she does not claim any available additional first-year depreciation. a. determine lori’s total cost recovery deduction if the ⧠179 expense is first taken with respect to the 5-year class asset. b. determine lori’s total cost recovery deduction if the ⧠179 expense is first taken with respect to the 7-year class asset. c. what is your advice for lori? d. assume that lori is in the 24% marginal tax bracket and that she uses ⧠179 on the 7-year asset. determine the present value of the tax savings from the depreciation deductions for both assets. see appendix g for present value factors, and assume a 6% discount rate. e. assume the same facts as in part (d), except that lori decides not to use ⧠179 on either asset. determine the present value of the tax savings under this choice. in addition, determine which option lori should choose. f. present your solution to parts (d) and (e) of the problem in a spreadsheet using appropriate microsoft excel formulas. e-mail your spreadsheet to your instructor with a two-paragraph summary of your findings.

Answers: 1

Business, 22.06.2019 14:30

Which of the following is an example of a positive externality? a. promoting generic drugs would benefit people. b. a lower inflation rate would benefit most consumers. c. compulsory flu shots for all students prevents the spread of illness in the general public. d. singapore has adopted a comprehensive savings plan for all workers known as the central provident fund.

Answers: 1

You know the right answer?

Mortgages, loans taken to purchase a property, involve regular payments at fixed intervals and are t...

Questions

Computers and Technology, 18.03.2020 12:45

Social Studies, 18.03.2020 12:50

Social Studies, 18.03.2020 12:50

Mathematics, 18.03.2020 12:57

Mathematics, 18.03.2020 12:58

Mathematics, 18.03.2020 12:59

Mathematics, 18.03.2020 13:01

Mathematics, 18.03.2020 13:02

Mathematics, 18.03.2020 13:03

Mathematics, 18.03.2020 13:04

Physics, 18.03.2020 13:06

Computers and Technology, 18.03.2020 13:07

Mathematics, 18.03.2020 13:08

English, 18.03.2020 13:13