Business, 18.09.2019 02:20 itscheesycheedar

An airport in japan is planning to purchase a parcel of land for building additional executive hangars in five years. the price of land currently is $2,000,000. the average inflation rate is 5 percent in the next five years. how much should the airport invest in a uniform amount per year for five years in an account that pays 8 percent interest annually to be able to purchase the land in five years?

Answers: 3

Another question on Business

Business, 22.06.2019 17:30

What do you think: would it be more profitable to own 200 shares of penny’s pickles or 1 share of exxon? why do you think that?

Answers: 1

Business, 22.06.2019 19:20

Sanibel autos inc. merged with its competitor vroom autos inc. this allowed sanibel autos to use its technological competencies along with vroom autos' marketing capabilities to capture a larger market share than what the two entities individually held. what type of integration does this scenario best illustrate? a. vertical b. technological c. horizontal d. perfect

Answers: 2

Business, 23.06.2019 00:00

Match each economic concept with the scenarios that illustrates it

Answers: 2

Business, 23.06.2019 00:00

1. consider a two-firm industry. firm 1 (the incumbent) chooses a level of output qı. firm 2 (the potential entrant) observes qı and then chooses its level of output q2. the demand for the product is p 100 q, where q is the total output sold by the two firms which equals qi +q2. assume that the marginal cost of each firm is zero. a) find the subgame perfect equilibrium levels of qi and q2 keeping in mind that firm 1 chooses qi first and firm 2 observes qi and chooses its q2. find the profits of the two firms-n1 and t2- in the subgame perfect equilibrium. how do these numbers differ from the cournot equilibrium? b) for what level of qi would firm 2 be deterred from entering? would a rational firm 1 have an incentive to choose this level of qi? which entry condition does this market have: blockaded, deterred, or accommodated? now suppose that firm 2 has to incur a fixed cost of entry, f> 0. c) for what values of f will entry be blockaded? d) find out the entry deterring level of q, denoted by q1', a expression for firm l's profit, when entry is deterred, as a function of f. for what values of f would firm 1 use an entry deterring strategy?

Answers: 3

You know the right answer?

An airport in japan is planning to purchase a parcel of land for building additional executive hanga...

Questions

Social Studies, 23.11.2020 18:30

Mathematics, 23.11.2020 18:30

English, 23.11.2020 18:30

Mathematics, 23.11.2020 18:30

Mathematics, 23.11.2020 18:30

Medicine, 23.11.2020 18:30

Arts, 23.11.2020 18:30

Mathematics, 23.11.2020 18:30

English, 23.11.2020 18:30

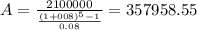

$357,958.55

$357,958.55 , that means that the future value of the land will be $2'100,000.

, that means that the future value of the land will be $2'100,000. with

with  and

and  %, so we have

%, so we have