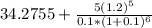

Consider the following three stocks: stock a is expected to provide a dividend of $10 a share forever. stock b is expected to pay a dividend of $5 next year. thereafter, dividend growth is expected to be 4% a year forever. stock c is expected to pay a dividend of $5 next year. thereafter, dividend growth is expected to be 20% a year for five years (i. e., years 2 through 6) and zero thereafter. if the market capitalization rate for each stock is 10%, which stock is the most valuable?

Answers: 3

Another question on Business

Business, 21.06.2019 15:30

Which of the following statements accurately describes how costs and benefits are calculated?

Answers: 1

Business, 22.06.2019 11:20

Aborrower takes out a 30-year adjustable rate mortgage loan for $200,000 with monthly payments. the first two years of the loan have a "teaser" rate of 4%, after that, the rate can reset with a 5% annual payment cap. on the reset date, the composite rate is 6%. what would the year 3 monthly payment be?

Answers: 3

Business, 22.06.2019 11:30

Which of the following statements about cash basis accounting is true? a. it is more complicated than accrual basis accounting. b. the irs allows all types of corporations to use it. c. it follows gaap standards. d. it ensures the company always knows how much cash flow it has.

Answers: 2

Business, 22.06.2019 22:00

Your sister turned 35 today, and she is planning to save $60,000 per year for retirement, with the first deposit to be made one year from today. she will invest in a mutual fund that's expected to provide a return of 7.5% per year. she plans to retire 30 years from today, when she turns 65, and she expects to live for 25 years after retirement, to age 90. under these assumptions, how much can she spend each year after she retires? her first withdrawal will be made at the end of her first retirement year.

Answers: 3

You know the right answer?

Consider the following three stocks: stock a is expected to provide a dividend of $10 a share forev...

Questions

English, 13.07.2019 10:00

Mathematics, 13.07.2019 10:00

Business, 13.07.2019 10:00

English, 13.07.2019 10:00

Chemistry, 13.07.2019 10:00

Spanish, 13.07.2019 10:00

Mathematics, 13.07.2019 10:00

Business, 13.07.2019 10:00

Social Studies, 13.07.2019 10:00

Mathematics, 13.07.2019 10:00

Computers and Technology, 13.07.2019 10:00

=$100

=$100

= $83.33

= $83.33

=$104.51

=$104.51